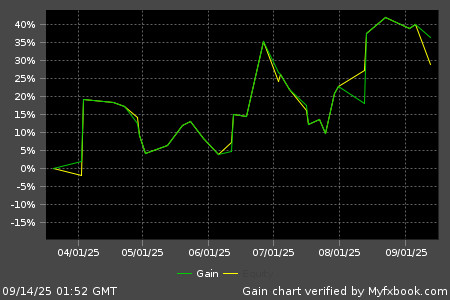

Live Performance

FirstTrade:03/20/2025 00:00 LastUpdate:09/14/2025 08:05

| Total gain | 28% |

| Daily gain | 0.14% |

| Monthly gain | 4% |

| Drawdown | 19% |

| ProfitFactor | 1.35 |

| Pips | 172.5 |

| Currency | USD |

| Deposits | 200 |

| Profit | 56.86 |

| Balance | 256.86 |

| Equity | 256.86 |

| Interest | 0 |

Broker : HF Markets

(REAL)

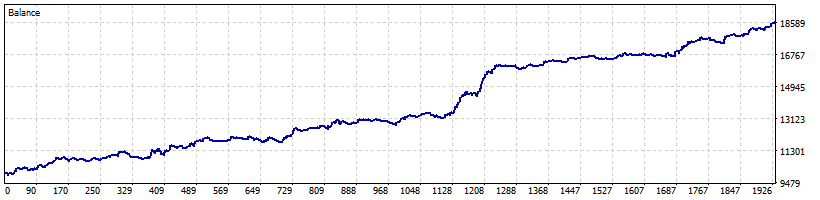

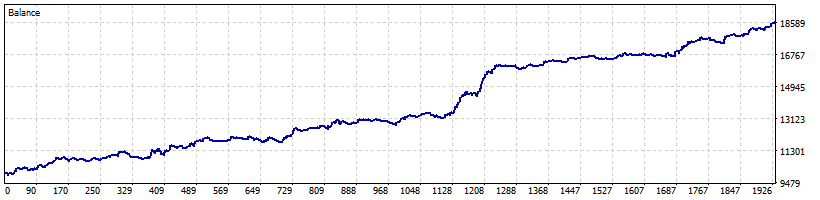

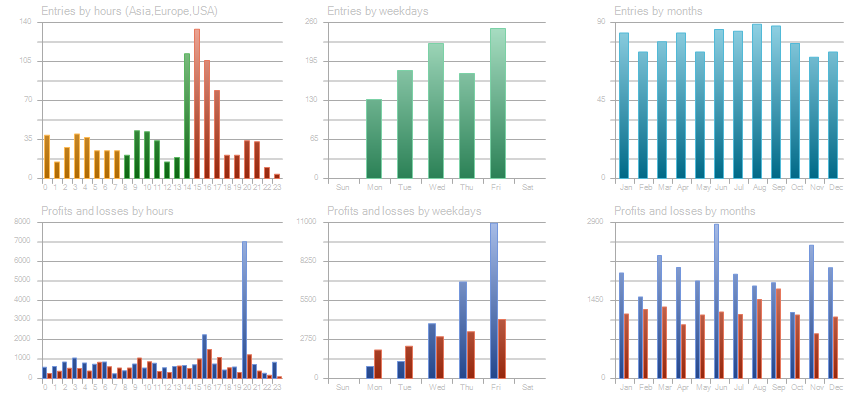

Backtesting

Test Period:2005.01.03 - 2025.07.09 (7492 days)

| Total Gain | 86.6% |

| Yearly Gain | 3.1% |

| Monthly Gain | 0.3% |

| Daily Gain | 0.01% |

| Relative Drawdown | 4.7% |

| Profit Factor | 1.57 |

| Currency | USD |

| Final Balance | 18663.28 |

| Initial Deposit | 10000 |

| Total Net Profit | 8663.28 |

| Total Trades | 962 |

| Ttimeframe | H1 |

Description

Trend-Following EA Combining Versatility and Robustness

This EA completely eliminates the use of Martingale and grid strategies, and it does not employ scalping logic, so it is not overly affected by account leverage or spreads. By applying a simple yet reliable set of trading rules identically across three currency pairs—EURUSD and USDJPY—it achieves genuine versatility without excessive optimization.

Key Features

Symmetrical Long/Short Rules

The long (buy) and short (sell) trading logic are designed symmetrically, preventing bias toward any one market direction and ensuring entry and exit decisions follow the same criteria in all scenarios.

Entries Based on the Ichimoku Kinko Hyo

The Ichimoku Kinko Hyo indicator is used to identify trend reversal points. As a well-established, highly reliable signal, it captures stable entry opportunities.

Long-Term Backtesting & Cross-Pair Performance

Proven in 20 years of backtesting across multiple currency pairs. Recommended pairs are EURUSD and USDJPY. While performance on XAUUSD, GBPUSD, and others isn’t outstanding, the fact that it still performs reasonably indicates the logic’s versatility.

Risk–Reward–Focused Design

Rather than aiming for a high win rate, the EA limits per-trade losses and targets significant profits by capturing strong breakouts. All positions have stop-loss orders, and no trades are held over weekends.

Suitable for Small Accounts

Equipped with automatic lot-size adjustment, it can operate effectively even with modest capital, controlling risk while aiming for larger gains in line with market momentum.

Recommended For

- Traders who prioritize versatile logic and don’t want an EA that depends heavily on specific market conditions

- Investors planning long-term operation and willing to endure drawdown periods patiently

- Those looking to start with small capital and scale up over time

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5147) |

||||||||||||

Settings |

||||||||||||

| Expert: | Multi Currency Portfolio EA Ichi | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2005.01.03 - 2025.07.09) | |||||||||||

| Inputs: | MM=false | |||||||||||

| Per_USD_001Lot=200 | ||||||||||||

| Lot_Fixed=0.1 | ||||||||||||

| MagicStart=111111 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 10 000.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 127150 | Ticks: | 29339330 | Symbols: | 1 | |||||||

| Total Net Profit: | 8 663.28 | Balance Drawdown Absolute: | 82.46 | Equity Drawdown Absolute: | 88.44 | |||||||

| Gross Profit: | 23 731.34 | Balance Drawdown Maximal: | 441.06 (3.91%) | Equity Drawdown Maximal: | 529.37 (4.67%) | |||||||

| Gross Loss: | -15 068.06 | Balance Drawdown Relative: | 3.91% (441.06) | Equity Drawdown Relative: | 4.67% (529.37) | |||||||

| Profit Factor: | 1.57 | Expected Payoff: | 9.01 | Margin Level: | 49557.80% | |||||||

| Recovery Factor: | 16.37 | Sharpe Ratio: | 3.16 | Z-Score: | 1.59 (88.82%) | |||||||

| AHPR: | 1.0007 (0.07%) | LR Correlation: | 0.98 | OnTester result: | 0 | |||||||

| GHPR: | 1.0006 (0.06%) | LR Standard Error: | 519.25 | |||||||||

| Total Trades: | 962 | Short Trades (won %): | 468 (50.64%) | Long Trades (won %): | 494 (47.37%) | |||||||

| Total Deals: | 1924 | Profit Trades (% of total): | 471 (48.96%) | Loss Trades (% of total): | 491 (51.04%) | |||||||

| Largest profit trade: | 183.02 | Largest loss trade: | -91.19 | |||||||||

| Average profit trade: | 50.39 | Average loss trade: | -30.00 | |||||||||

| Maximum consecutive wins ($): | 11 (1 284.52) | Maximum consecutive losses ($): | 12 (-231.98) | |||||||||

| Maximal consecutive profit (count): | 1 284.52 (11) | Maximal consecutive loss (count): | -316.92 (4) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 2 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

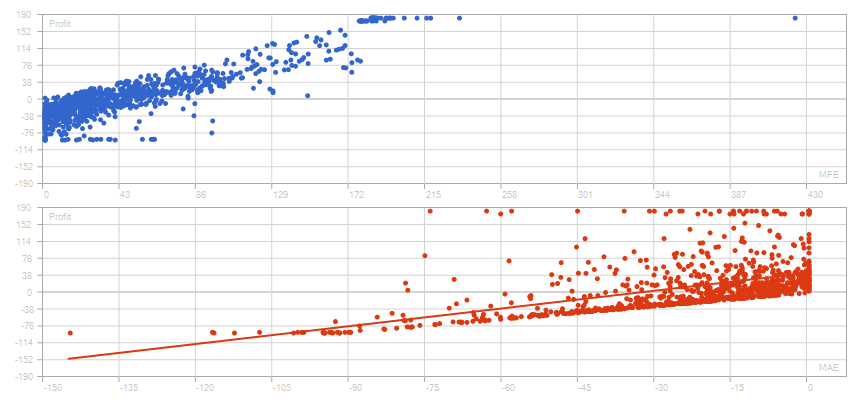

| Correlation (Profits,MFE): | 0.89 | Correlation (Profits,MAE): | 0.52 | Correlation (MFE,MAE): | 0.2922 | |||||||

|

||||||||||||

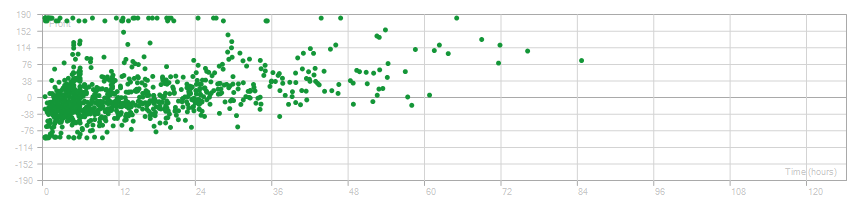

| Minimal position holding time: | 0:03:40 | Maximal position holding time: | 84:16:00 | Average position holding time: | 13:45:44 | |||||||

|

||||||||||||

Reviews

There are no reviews yet.