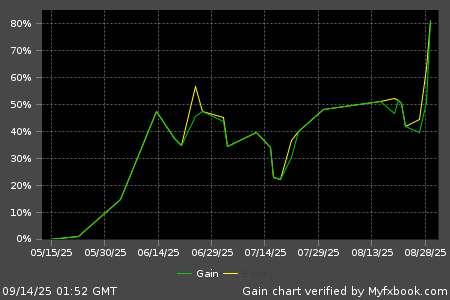

Live Performance

FirstTrade:05/14/2025 00:00 LastUpdate:09/14/2025 08:34

| Total gain | 81% |

| Daily gain | 0.48% |

| Monthly gain | 18% |

| Drawdown | 17% |

| ProfitFactor | 2.24 |

| Pips | 25329 |

| Currency | USD |

| Deposits | 300 |

| Profit | 243.11 |

| Balance | 543.11 |

| Equity | 543.11 |

| Interest | -7.38 |

Broker : IC Markets

(REAL)

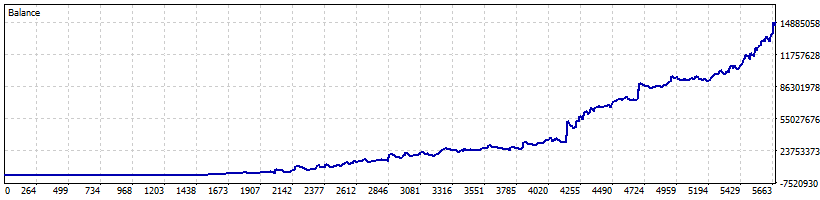

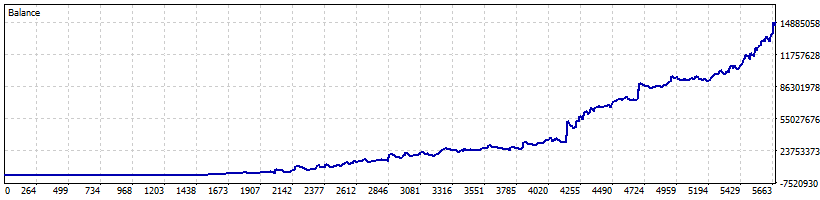

Backtesting

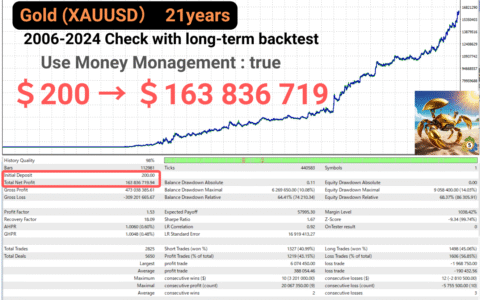

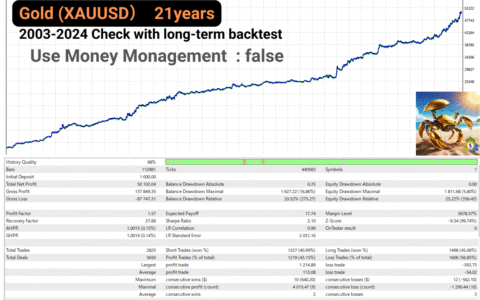

Test Period:2006.01.01 - 2025.05.10 (7069 days)

| Total Gain | 75211298.7% |

| Yearly Gain | 101.1% |

| Monthly Gain | 5.9% |

| Daily Gain | 0.19% |

| Relative Drawdown | 70.3% |

| Profit Factor | 1.5 |

| Currency | USD |

| Final Balance | 150422797.34 |

| Initial Deposit | 200 |

| Total Net Profit | 150422597.34 |

| Total Trades | 2828 |

| Ttimeframe | H1 |

Description

Gold Crab Robot EA Overview

Gold Crab Robot is an automated trading EA designed specifically for XAUUSD on the 1‑hour chart. It manages risk per trade strictly while combining three distinct trading logics in parallel to achieve balanced performance, even with small account sizes.

Key Features

- Simultaneous Use of 3 Logics

Integrates signals from Aroon, Bollinger Band Width Ratio (BB Width Ratio) and MTATR, plus Ichimoku & DeMarker, filtering entries only when all three agree. - No Martingale or Grid

Eliminates high‑risk methods to keep drawdowns under control. - Individual Stop Loss per Position

ATR‑based stop loss for each trade to limit unexpected losses. - Environment‑Agnostic Design

Not a scalping EA—minimizes sensitivity to broker spreads and leverage settings. - Auto Lot Size Adjustment (Compounding)

Dynamically calculates position size based on account balance to target growth from small capital. - Symmetric Buy/Sell Rules

Long and short entries use identical criteria to avoid directional bias and over‑optimization.

Trading Logic Overview

Gold Crab Robot monitors three independent strategies and enters only when all align:

1. Aroon Cross Logic

- Indicator: Aroon Up & Down (Period = 20)

- Signal: Aroon Up crosses above/below Aroon Down

2. BB Width Ratio Logic

- Indicator: Bollinger Band Width Ratio (Period = 69) + MTATR (Period = 199)

- Signal: Band expansion filtered by volatility

3. Ichimoku & DeMarker Logic

- Indicators: Ichimoku Kijun‑Sen crossover (Periods 9/26/52) + DeMarker (Period = 50)

- Signal: Price crosses Kijun‑Sen with DeMarker confirming trend direction

When all three logics signal in the same direction:

- Entry via stop orders adjusted by volatility multipliers

- Stop Loss: ATR-based level per scenario

- Take Profit: ATR-based or fixed percentage

- Trailing Stop: Dynamic ATR-based trail

- Break-even Move: Move SL to entry after ATR threshold

Operating Environment & Supported Brokers

- Symbol: XAUUSD

- Timeframe: 1‑Hour (H1)

- Platform: MetaTrader 5 (Hedged account mode)

- Broker Requirements: No special filters—runs on any standard MT5 setup

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4885) |

||||||||||||

Settings |

||||||||||||

| Expert: | Gold Crab Robot | |||||||||||

| Symbol: | XAUUSD | |||||||||||

| Period: | H1 (2006.01.01 - 2025.05.10) | |||||||||||

| Inputs: | MagicNumber1=11111 | |||||||||||

| MagicNumber2=22222 | ||||||||||||

| MagicNumber3=33333 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=0.5 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 200.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

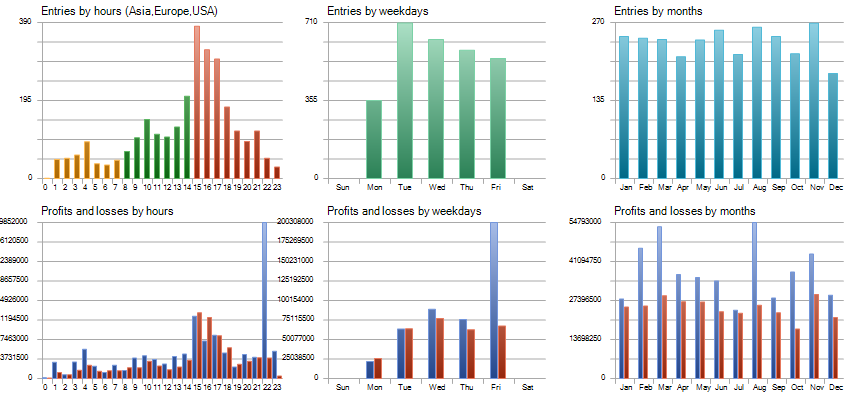

Results |

||||||||||||

| History Quality: | 98% | |||||||||||

| Bars: | 112981 | Ticks: | 24449875 | Symbols: | 1 | |||||||

| Total Net Profit: | 150 422 597.34 | Balance Drawdown Absolute: | 0.11 | Equity Drawdown Absolute: | 0.00 | |||||||

| Gross Profit: | 451 060 390.96 | Balance Drawdown Maximal: | 6 279 650.00 (12.01%) | Equity Drawdown Maximal: | 9 061 900.00 (16.58%) | |||||||

| Gross Loss: | -300 637 793.62 | Balance Drawdown Relative: | 66.60% (74 660.15) | Equity Drawdown Relative: | 70.31% (86 353.74) | |||||||

| Profit Factor: | 1.50 | Expected Payoff: | 53 190.45 | Margin Level: | 920.04% | |||||||

| Recovery Factor: | 16.60 | Sharpe Ratio: | 2.11 | Z-Score: | -9.42 (99.74%) | |||||||

| AHPR: | 1.0060 (0.60%) | LR Correlation: | 0.90 | OnTester result: | 0 | |||||||

| GHPR: | 1.0048 (0.48%) | LR Standard Error: | 17 045 306.41 | |||||||||

| Total Trades: | 2828 | Short Trades (won %): | 1327 (40.77%) | Long Trades (won %): | 1501 (44.30%) | |||||||

| Total Deals: | 5656 | Profit Trades (% of total): | 1206 (42.64%) | Loss Trades (% of total): | 1622 (57.36%) | |||||||

| Largest profit trade: | 6 074 450.00 | Largest loss trade: | -1 968 750.00 | |||||||||

| Average profit trade: | 374 013.59 | Average loss trade: | -183 343.41 | |||||||||

| Maximum consecutive wins ($): | 9 (20 066 850.00) | Maximum consecutive losses ($): | 12 (-2 810 500.00) | |||||||||

| Maximal consecutive profit (count): | 20 066 850.00 (9) | Maximal consecutive loss (count): | -5 755 500.00 (10) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

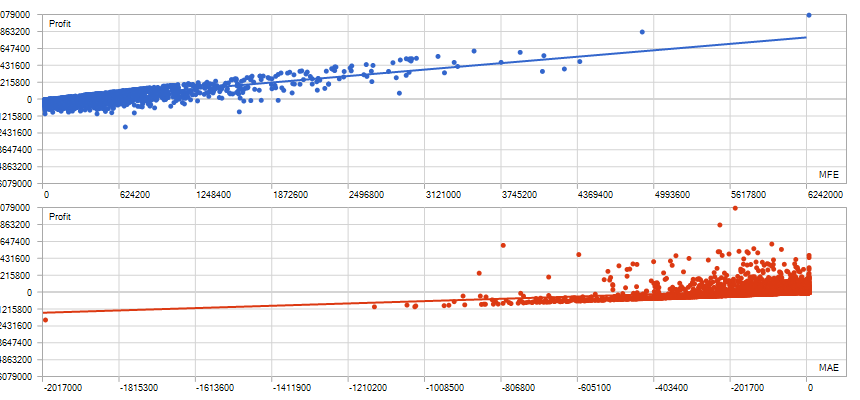

| Correlation (Profits,MFE): | 0.83 | Correlation (Profits,MAE): | 0.31 | Correlation (MFE,MAE): | -0.0924 | |||||||

|

||||||||||||

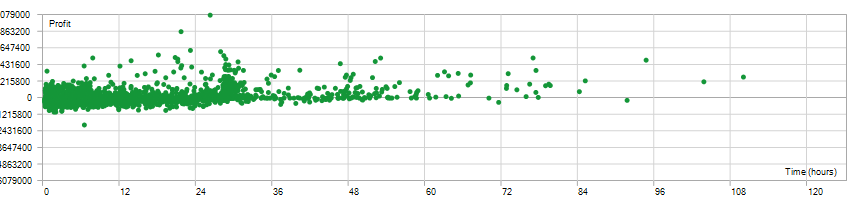

| Minimal position holding time: | 0:00:01 | Maximal position holding time: | 109:41:20 | Average position holding time: | 12:19:25 | |||||||

|

||||||||||||

Reviews

There are no reviews yet.