$ 99

1 Account license for MT5

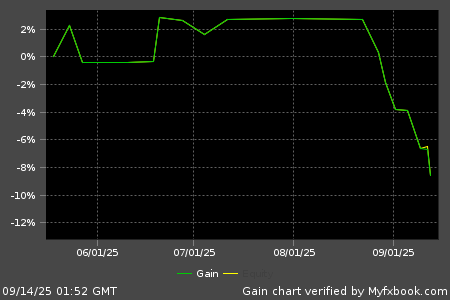

Live Performance

FirstTrade:05/18/2025 00:00 LastUpdate:09/14/2025 09:15

| Total gain | -9% |

| Daily gain | -0.08% |

| Monthly gain | -2% |

| Drawdown | 11% |

| ProfitFactor | 0.44 |

| Pips | -173.9 |

| Currency | USD |

| Deposits | 150 |

| Profit | -12.89 |

| Balance | 137.11 |

| Equity | 137.11 |

| Interest | 0.26 |

Broker : IC Markets

(REAL)

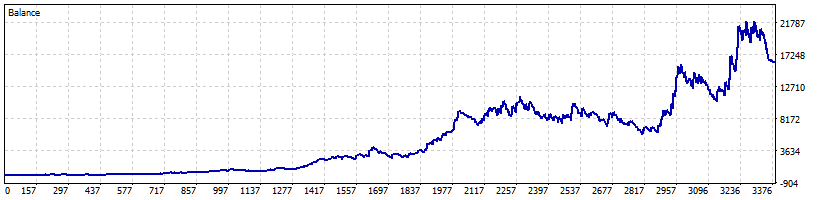

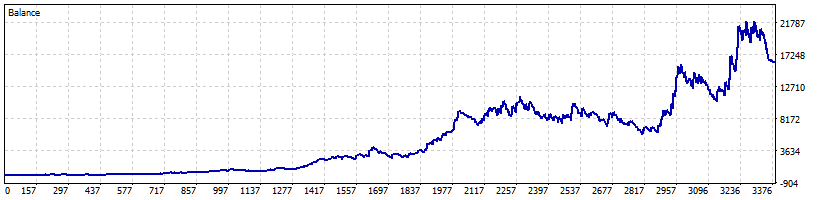

Backtesting

Test Period:2005.01.03 - 2025.07.23 (7506 days)

| Total Gain | 9127% |

| Yearly Gain | 24.6% |

| Monthly Gain | 1.8% |

| Daily Gain | 0.06% |

| Relative Drawdown | 50% |

| Profit Factor | 1.2 |

| Currency | USD |

| Final Balance | 18454.09 |

| Initial Deposit | 200 |

| Total Net Profit | 18254.09 |

| Total Trades | 1686 |

| Ttimeframe | H1 |

Description

USDJPY H1 Expert Advisor – Robust Risk Management & Symmetric Logic

EA Overview

This Expert Advisor (EA) is tuned for MetaTrader 5 and specifically targets USDJPY on the one‑hour chart.

It combines momentum signals from a primary oscillator with high/low breakouts and volatility filters to create a straightforward yet reliable entry strategy.

Every position carries a fixed stop‑loss, while a trailing function helps lock in gains as trades move in your favor.

Risk Management Policy

- Clearly defined maximum loss per trade.

- Stop‑loss distance adapts to current volatility levels.

Trading Algorithm

1 Trend Assessment

Momentum is detected when a designated oscillator crosses its zero line up or down.

2 Breakout Validation

The EA references recent high/low ranges and adjusts the entry trigger by the latest volatility band.

Orders are placed only if price reaches the trigger within a limited time window after the signal.

3 Risk‑to‑Reward Settings

Stop‑loss distances are calculated from ATR values; profit targets use a fixed percentage approach.

When floating profit expands, the stop is moved to breakeven to secure capital.

4 Execution Time Filter

New trades are avoided during low‑liquidity periods, such as weekend sessions.

Feature Highlights

| # | Feature | Description |

|---|---|---|

| 1 | No Martingale / Grid | Risk is never escalated through additional averaging. |

| 2 | Individual Stop‑Loss | Each position has its own protective exit to shield account equity. |

| 3 | Non‑Scalping Design | Does not rely on ultra‑short holding times, making it less sensitive to spreads or execution speed. |

| 4 | Automatic Lot Scaling | Lot size adjusts with account balance, enabling capital growth from smaller deposits. |

| 5 | Symmetric Buy/Sell Logic | Identical criteria for long and short trades minimize optimization bias. |

Recommended Environment

- Platform: MetaTrader 5 (hedge account)

- Pair: USDJPY

- Timeframe: H1 (one‑hour chart)

- Minimum Capital: Flexible—lot size is auto‑scaled to balance, making small accounts viable.

Disclaimer

This EA is developed from historical market data and does not guarantee future profits.

Automated trading involves risk of capital loss and sizeable drawdowns; operate only with funds you can afford to lose.

Thorough testing on a demo account is strongly recommended before going live.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5147) |

||||||||||||

Settings |

||||||||||||

| Expert: | ZenTrader | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2005.01.03 - 2025.07.23) | |||||||||||

| Inputs: | MagicNumber=11111 | |||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=2.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

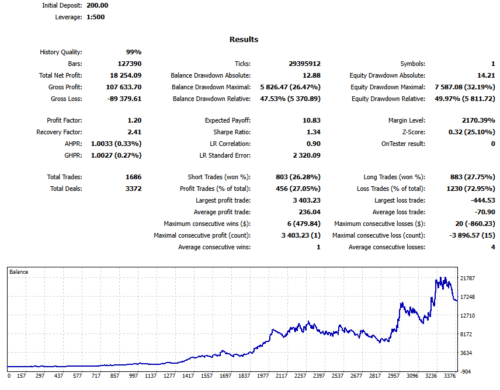

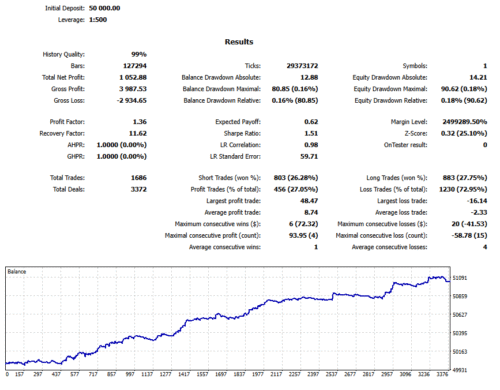

| Initial Deposit: | 200.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 127390 | Ticks: | 29395912 | Symbols: | 1 | |||||||

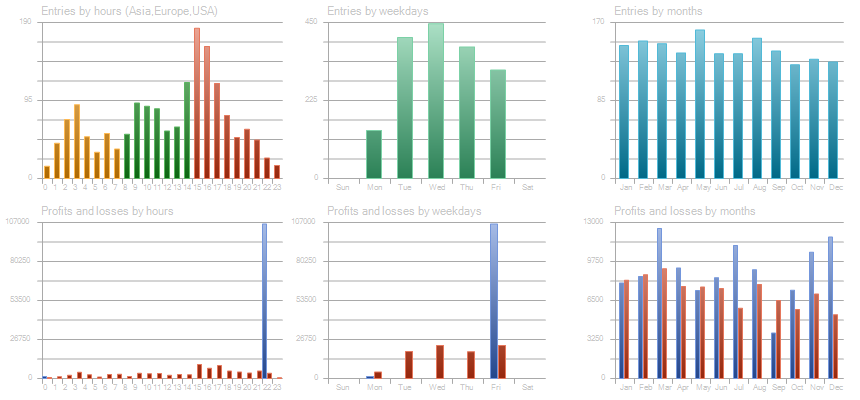

| Total Net Profit: | 18 254.09 | Balance Drawdown Absolute: | 12.88 | Equity Drawdown Absolute: | 14.21 | |||||||

| Gross Profit: | 107 633.70 | Balance Drawdown Maximal: | 5 826.47 (26.47%) | Equity Drawdown Maximal: | 7 587.08 (32.19%) | |||||||

| Gross Loss: | -89 379.61 | Balance Drawdown Relative: | 47.53% (5 370.89) | Equity Drawdown Relative: | 49.97% (5 811.72) | |||||||

| Profit Factor: | 1.20 | Expected Payoff: | 10.83 | Margin Level: | 2170.39% | |||||||

| Recovery Factor: | 2.41 | Sharpe Ratio: | 1.34 | Z-Score: | 0.32 (25.10%) | |||||||

| AHPR: | 1.0033 (0.33%) | LR Correlation: | 0.90 | OnTester result: | 0 | |||||||

| GHPR: | 1.0027 (0.27%) | LR Standard Error: | 2 320.09 | |||||||||

| Total Trades: | 1686 | Short Trades (won %): | 803 (26.28%) | Long Trades (won %): | 883 (27.75%) | |||||||

| Total Deals: | 3372 | Profit Trades (% of total): | 456 (27.05%) | Loss Trades (% of total): | 1230 (72.95%) | |||||||

| Largest profit trade: | 3 403.23 | Largest loss trade: | -444.53 | |||||||||

| Average profit trade: | 236.04 | Average loss trade: | -70.90 | |||||||||

| Maximum consecutive wins ($): | 6 (479.84) | Maximum consecutive losses ($): | 20 (-860.23) | |||||||||

| Maximal consecutive profit (count): | 3 403.23 (1) | Maximal consecutive loss (count): | -3 896.57 (15) | |||||||||

| Average consecutive wins: | 1 | Average consecutive losses: | 4 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

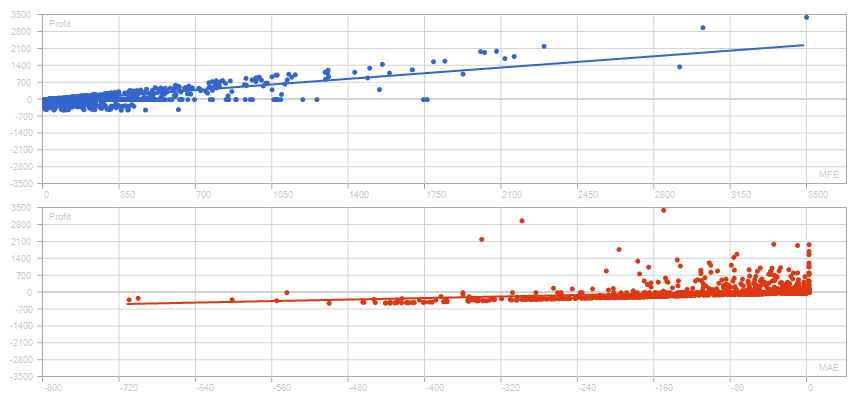

| Correlation (Profits,MFE): | 0.78 | Correlation (Profits,MAE): | 0.30 | Correlation (MFE,MAE): | -0.1070 | |||||||

|

||||||||||||

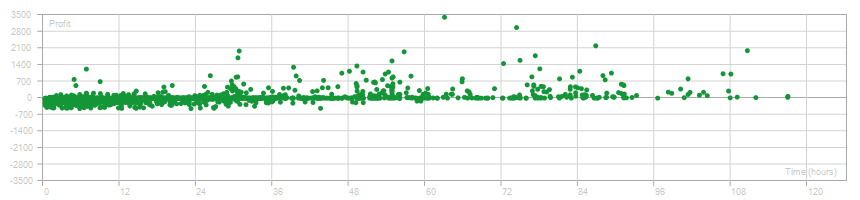

| Minimal position holding time: | 0:00:20 | Maximal position holding time: | 116:40:20 | Average position holding time: | 23:26:40 | |||||||

|

||||||||||||

Reviews

There are no reviews yet.