Live Performance Full Result with Myfxbook

Failed to retrieve image data.

| Total Gain | -4% |

| Daily Gain | -0.03% |

| Monthly Gain | -1% |

| Drawdown | 20% |

| Profit Factor | 0.91 |

| Total Pips | -105.4pips |

| Account Currency | USD |

| Deposit | $ 200 |

| Profit | $ -7.14 |

| Balance | $ 192.86 |

| Equity | $ 192.86 |

| Swap | $ -1.32 |

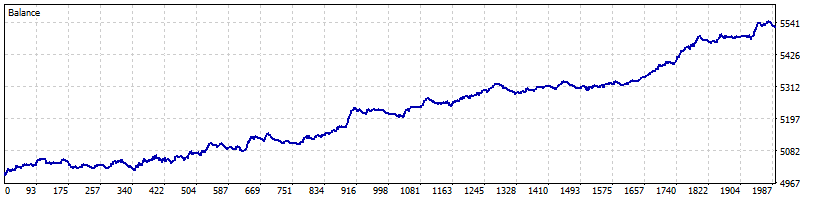

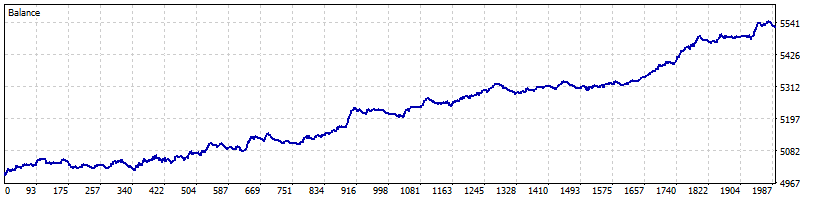

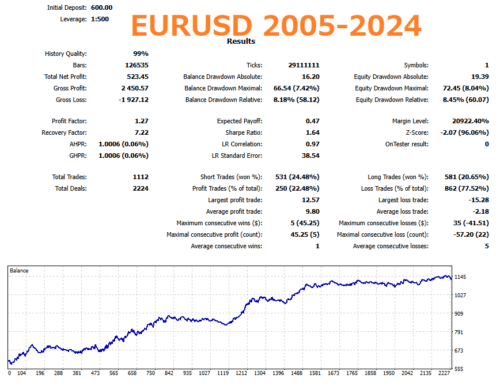

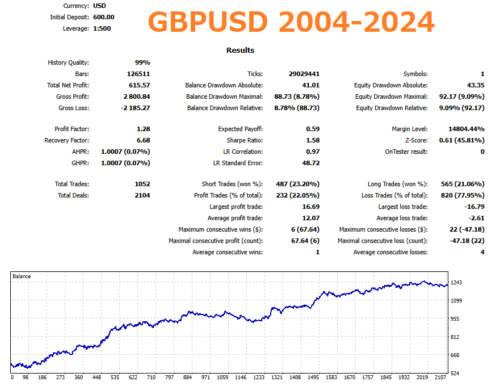

Backtesting

| Total Gain | 10.5% |

| Yearly Gain | 0.5% |

| Monthly Gain | 0% |

| Daily Gain | 0% |

| Relative Drawdown | 1% |

| Profit Factor | 1.39 |

| Currency | USD |

| Final Balance | 5524.51 |

| Initial Deposit | 5000 |

| Total Net Profit | 524.51 |

| Total Trades | 992 |

| Timeframe | H1 |

![]() MetaTrader 5 (MT5)

MetaTrader 5 (MT5)

- Works even with low leverage (1:25, 1:30, etc.)

- No Martingale, no Grid, no Scalping

- Low-risk strategy with an excellent Risk-Reward Ratio (RR)

- Verified with forward testing on real accounts

- Verified with backtesting over 20+ years

Description

Tiger Neon EA’s key selling point is its blend of quantitative technical analysis and rigorous risk management. Experience its high versatility by running the same logic across EURUSD / GBPUSD / USDJPY / EURJPY on the 1‑hour timeframe.

Supported Currency Pairs

EURUSD / GBPUSD / USDJPY / EURJPY (1H)

Overview

Tiger Neon EA is an FX automated trading system that combines linear regression analysis, which captures trend changes, with Bollinger Band range to generate entry signals, and automatically sets stop loss and break-even levels based on ATR. It does not employ risky Martingale or grid trading strategies, instead focusing on controlled risk per trade to steadily grow your capital.

Key Features

- No Martingale/Grid: No excessive averaging down or chase orders; independent risk management per position.

- Individual Stop Loss: Automatic ATR-based stop loss for each entry, adapting to market volatility.

- Non-Scalping Design: Designed to be insensitive to short-term noise, reducing dependence on brokers or servers.

- Auto Lot Sizing (Compounding): Supports compounding to increase lot size gradually, maximizing capital efficiency even with small balance.

- Symmetric Buy/Sell Logic: Entry and exit rules are mirror images for buy and sell, avoiding over‑optimization and ensuring stability across various markets.

Internal Logic Overview

Trend Determination

The EA calculates the slope of a linear regression on past price data to detect trend reversals.

Entry Conditions

Pending stop orders are placed at recent highs/lows plus or minus a multiple of the Bollinger Band range.

Risk Management

Stop loss is set based on ATR (Average True Range) and dynamically adjusted to market volatility. After a specified number of pips in profit, it automatically moves to break-even.

Position Expiry

Includes an automatic order cancellation feature based on bar count to reduce stale orders and avoid positions held unintentionally.

Operation Points

– Optimized for 1‑hour charts

– No strict trade count or distance limits, allowing the EA to capture a wide range of market moves

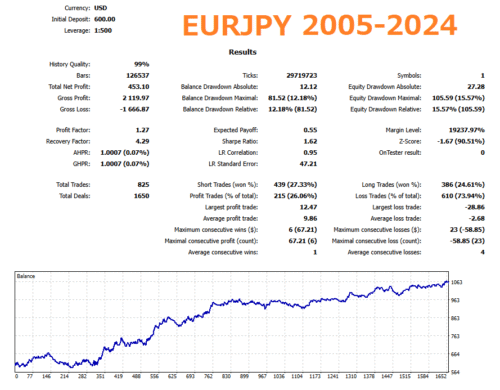

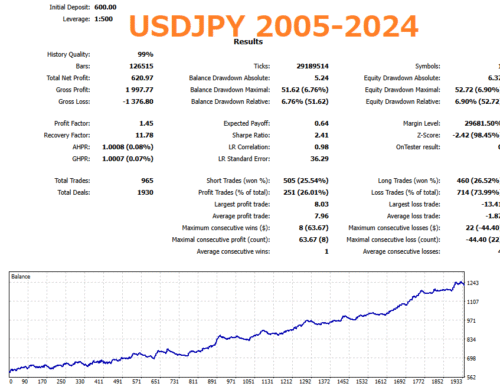

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5147) |

||||||||||||

Settings |

||||||||||||

| Expert: | Tiger Neon | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2005.01.03 - 2025.07.23) | |||||||||||

| Inputs: | MagicNumber=11111 | |||||||||||

| cat1=//////////Entry////////// | ||||||||||||

| LinerRegPeriod=14 | ||||||||||||

| BandDev=1.9 | ||||||||||||

| BandPeriod=20 | ||||||||||||

| cat2=//////////Close////////// | ||||||||||||

| StopLossAdjust=2.3 | ||||||||||||

| TakeProfitPercent=0.8 | ||||||||||||

| BreakEvenAdjust=1.3 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=false | ||||||||||||

| mmRiskPercent=3.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:30 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 5 000.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 127390 | Ticks: | 29395912 | Symbols: | 1 | |||||||

| Total Net Profit: | 524.51 | Balance Drawdown Absolute: | 5.24 | Equity Drawdown Absolute: | 6.37 | |||||||

| Gross Profit: | 1 886.28 | Balance Drawdown Maximal: | 44.24 (0.87%) | Equity Drawdown Maximal: | 47.98 (0.95%) | |||||||

| Gross Loss: | -1 361.77 | Balance Drawdown Relative: | 0.87% (44.24) | Equity Drawdown Relative: | 0.95% (47.98) | |||||||

| Profit Factor: | 1.39 | Expected Payoff: | 0.53 | Margin Level: | 249681.50% | |||||||

| Recovery Factor: | 10.93 | Sharpe Ratio: | 2.61 | Z-Score: | 0.15 (11.92%) | |||||||

| AHPR: | 1.0001 (0.01%) | LR Correlation: | 0.98 | OnTester result: | 0 | |||||||

| GHPR: | 1.0001 (0.01%) | LR Standard Error: | 31.36 | |||||||||

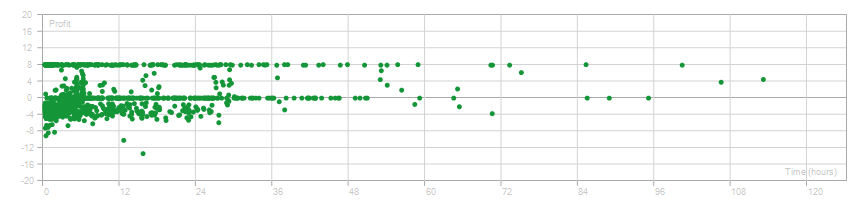

| Total Trades: | 992 | Short Trades (won %): | 518 (28.19%) | Long Trades (won %): | 474 (33.54%) | |||||||

| Total Deals: | 1984 | Profit Trades (% of total): | 305 (30.75%) | Loss Trades (% of total): | 687 (69.25%) | |||||||

| Largest profit trade: | 8.03 | Largest loss trade: | -13.41 | |||||||||

| Average profit trade: | 6.18 | Average loss trade: | -1.92 | |||||||||

| Maximum consecutive wins ($): | 8 (63.67) | Maximum consecutive losses ($): | 19 (-11.61) | |||||||||

| Maximal consecutive profit (count): | 63.67 (8) | Maximal consecutive loss (count): | -27.95 (10) | |||||||||

| Average consecutive wins: | 1 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Correlation (Profits,MFE): | 0.85 | Correlation (Profits,MAE): | 0.56 | Correlation (MFE,MAE): | 0.4027 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 112:49:20 | Average position holding time: | 11:49:19 | |||||||

|

||||||||||||

General Inquiries

There are no inquiries yet.

Ask a Question

Reviews

There are no reviews yet.