$ 99

1 Account license for MT5

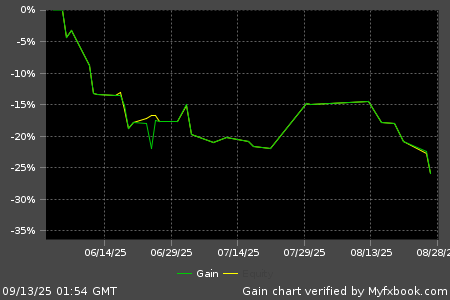

Live Performance

FirstTrade:06/02/2025 00:00 LastUpdate:09/14/2025 09:03

| Total gain | -26% |

| Daily gain | -0.29% |

| Monthly gain | -10% |

| Drawdown | 26% |

| ProfitFactor | 0.47 |

| Pips | -11447.5 |

| Currency | USD |

| Deposits | 400 |

| Profit | -103.71 |

| Balance | 296.29 |

| Equity | 296.29 |

| Interest | -1.78 |

Broker : IC Markets

(REAL)

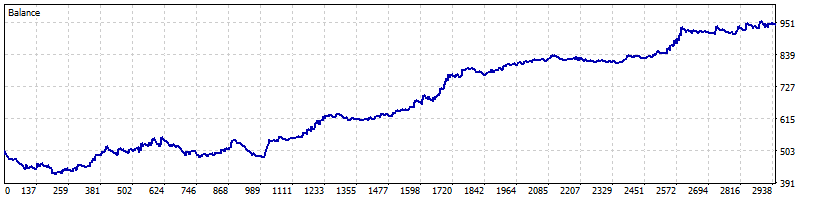

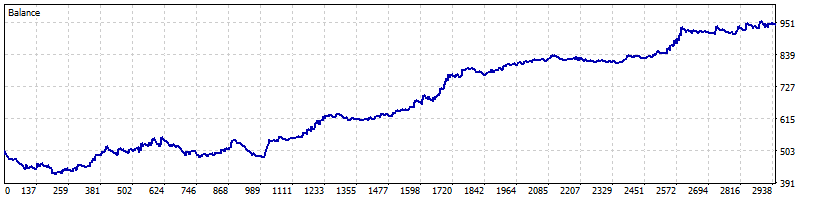

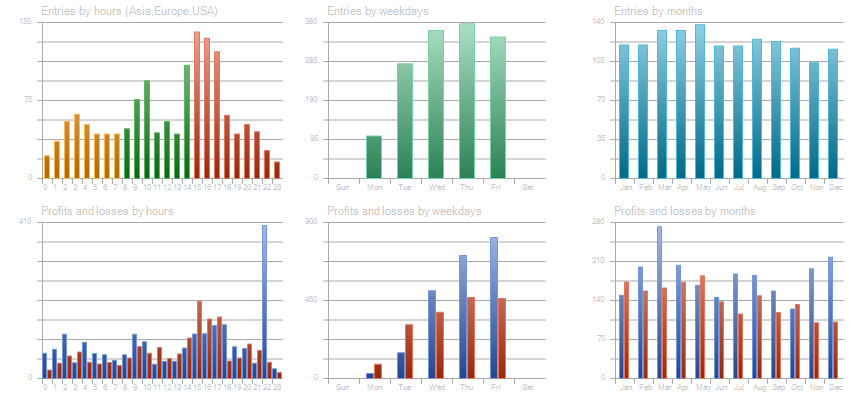

Backtesting

Test Period:2005.01.03 - 2025.07.23 (7506 days)

| Total Gain | 88.7% |

| Yearly Gain | 3.1% |

| Monthly Gain | 0.3% |

| Daily Gain | 0.01% |

| Relative Drawdown | 16.9% |

| Profit Factor | 1.25 |

| Currency | USD |

| Final Balance | 943.59 |

| Initial Deposit | 500 |

| Total Net Profit | 443.59 |

| Total Trades | 1467 |

| Ttimeframe | H1 |

Description

About Fish Carp Robot

“Fish Carp Robot” is an expert advisor (EA) developed for the H1 charts of major symbols such as EURUSD, GBPUSD, USDJPY, and XAUUSD. Designed to apply the same logic across multiple currency pairs, it pursues stable performance even when market environments differ. In addition, dynamic stop adjustments based on ATR and an automatic lot-sizing (compounding) feature enhance capital efficiency while maintaining risk control.

Main Symbols & Timeframe

| Symbol | Recommended Timeframe |

|---|---|

| EURUSD | H1 (1‑Hour) |

| GBPUSD | H1 |

| USDJPY | H1 |

| XAUUSD | H1 |

By running the same strategy on multiple symbols, portfolio diversification becomes easy. The fact that identical settings work across all pairs is a major strength of this EA.

Features & Benefits

1. Simple Symmetrical Logic

- Buy and sell both operate with the same algorithm

- Reduces over‑optimization, minimizing the gap between backtest and live performance

2. No Martingale or Grid

- Prioritizes money management, automatically adjusting position size via ATR and compounding

- Avoids sharp drawdowns during losing streaks

3. Robust to Changing Conditions

- Not a scalping EA, so it’s less sensitive to execution speed or spread variations

- Weekend and holiday disable settings are fully customizable

4. Automatic Lot Sizing (Compounding)

- Incrementally increases or decreases lot size based on accrued profit

- Enables smooth step‑up even from a small starting balance

5. Advanced Trailing & Break‑Even

- ATR‑based trailing stop to help extend profitable trades

- Automatically moves stop‑loss to break‑even once target levels are reached

Trading Logic Overview

Below is an outline of the logic’s key concepts. Detailed parameters are fine‑tuned internally.

Signal Generation

- Detects trend reversals using an Aroon‑based indicator

- Enters when crossover events occur

Order Placement

- Uses stop orders (limit/stop) combining recent highs/lows with past range width

- Automatically cancels unfilled orders after a set number of bars, then awaits the next signal

Stop‑Loss Configuration

- Calculates risk levels based on ATR (20 period)

- Applies a dynamic SL width aligned with current volatility rather than a fixed pip value

Take‑Profit Configuration

- Targets set via percentage or ATR-based calculation

- Flexible adjustments according to market volatility

Position Management

- Automatically shifts to break‑even once certain profits are achieved

- ATR‑driven trailing stop to maximize extension of winning trades

Who Should Use This EA?

- Traders aiming to capture medium‑term trends

- Anyone seeking automated trading across multiple currency pairs

- Those looking for an EA that’s resilient to changing market conditions

- Beginners to intermediate traders wanting to start with a small account

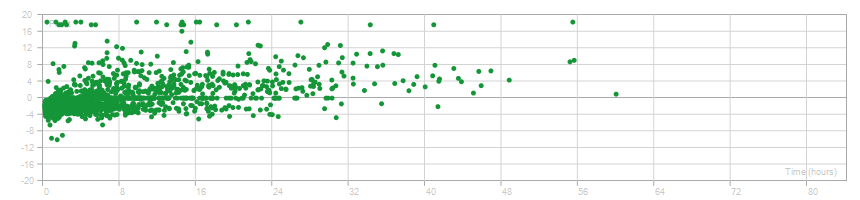

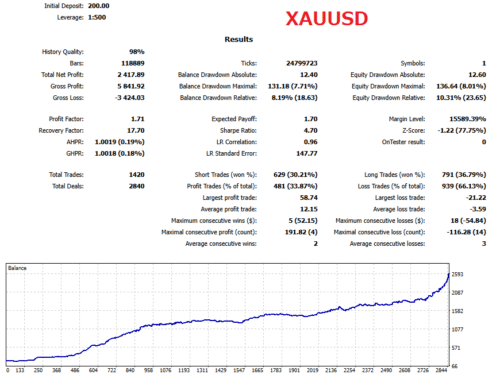

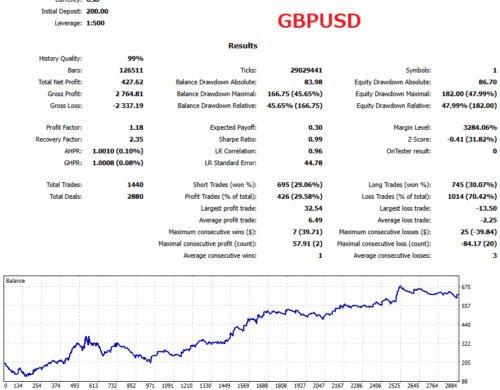

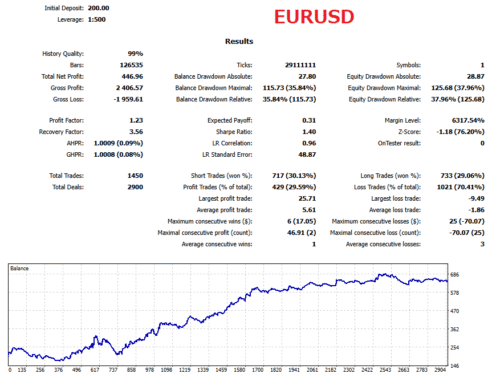

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5174) |

||||||||||||

Settings |

||||||||||||

| Expert: | Fish Carp Robot | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2005.01.03 - 2025.07.23) | |||||||||||

| Inputs: | MagicNumber=11111 | |||||||||||

| AroonPeriod=30 | ||||||||||||

| BreakEvenAdjust=1.0 | ||||||||||||

| EntryAdjustPeriod=184 | ||||||||||||

| EntryPeriod=40 | ||||||||||||

| PriceEntryMult1=0.1 | ||||||||||||

| StopLossAdjust=1.5 | ||||||||||||

| TakeProfitPercent=1.8 | ||||||||||||

| TrailStopAcrAdjust=2.5 | ||||||||||||

| TrailStopAdjust=1.7 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=false | ||||||||||||

| mmRiskPercent=2.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 500.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

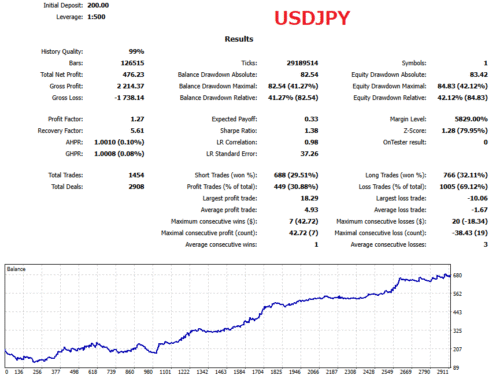

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 127390 | Ticks: | 29395912 | Symbols: | 1 | |||||||

| Total Net Profit: | 443.59 | Balance Drawdown Absolute: | 82.54 | Equity Drawdown Absolute: | 83.42 | |||||||

| Gross Profit: | 2 208.96 | Balance Drawdown Maximal: | 82.54 (16.51%) | Equity Drawdown Maximal: | 84.83 (16.92%) | |||||||

| Gross Loss: | -1 765.37 | Balance Drawdown Relative: | 16.51% (82.54) | Equity Drawdown Relative: | 16.92% (84.83) | |||||||

| Profit Factor: | 1.25 | Expected Payoff: | 0.30 | Margin Level: | 20829.00% | |||||||

| Recovery Factor: | 5.23 | Sharpe Ratio: | 1.69 | Z-Score: | 1.19 (76.60%) | |||||||

| AHPR: | 1.0005 (0.05%) | LR Correlation: | 0.98 | OnTester result: | 0 | |||||||

| GHPR: | 1.0004 (0.04%) | LR Standard Error: | 35.87 | |||||||||

| Total Trades: | 1467 | Short Trades (won %): | 689 (28.59%) | Long Trades (won %): | 778 (31.75%) | |||||||

| Total Deals: | 2934 | Profit Trades (% of total): | 444 (30.27%) | Loss Trades (% of total): | 1023 (69.73%) | |||||||

| Largest profit trade: | 18.29 | Largest loss trade: | -10.06 | |||||||||

| Average profit trade: | 4.98 | Average loss trade: | -1.67 | |||||||||

| Maximum consecutive wins ($): | 7 (42.72) | Maximum consecutive losses ($): | 20 (-19.48) | |||||||||

| Maximal consecutive profit (count): | 42.72 (7) | Maximal consecutive loss (count): | -38.43 (19) | |||||||||

| Average consecutive wins: | 1 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

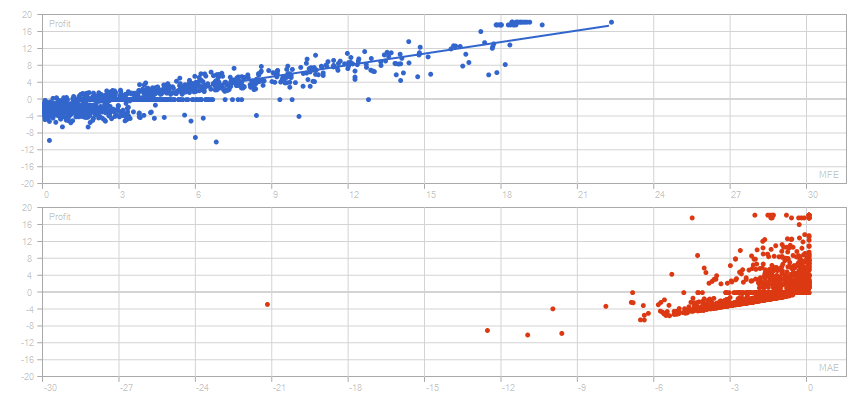

| Correlation (Profits,MFE): | 0.91 | Correlation (Profits,MAE): | 0.51 | Correlation (MFE,MAE): | 0.2999 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 59:47:40 | Average position holding time: | 8:23:42 | |||||||

|

||||||||||||

Reviews

There are no reviews yet.