$ 99

1 Account license for MT5

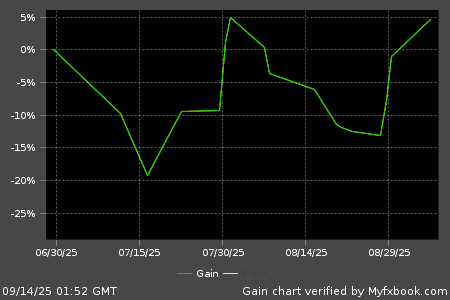

Live Performance

FirstTrade:06/29/2025 00:00 LastUpdate:09/13/2025 10:29

| Total gain | 5% |

| Daily gain | 0.06% |

| Monthly gain | 2% |

| Drawdown | 19% |

| ProfitFactor | 1.11 |

| Pips | 1842 |

| Currency | USD |

| Deposits | 300 |

| Profit | 14 |

| Balance | 314 |

| Equity | 314 |

| Interest | -4.42 |

Broker : XMTrading

(REAL)

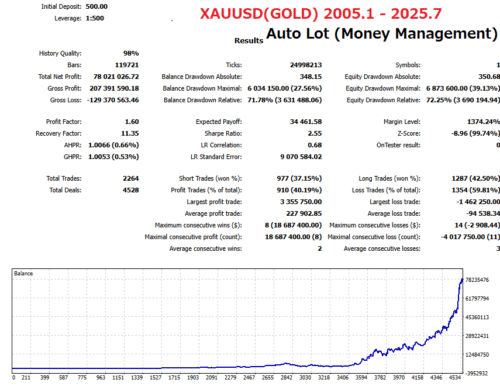

Backtesting

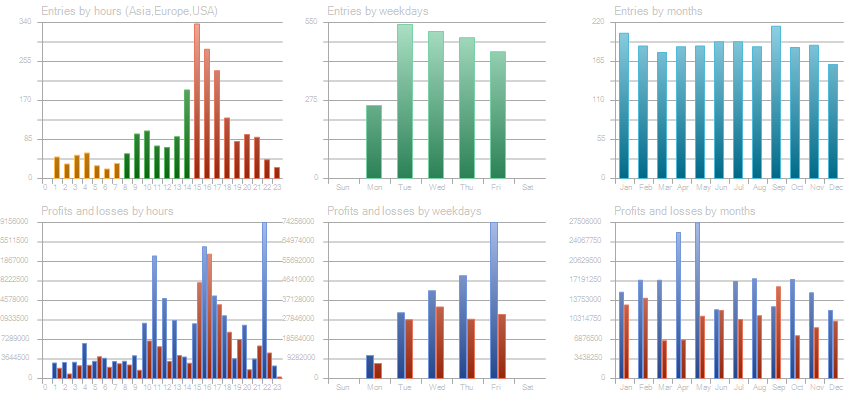

Test Period:2005.01.03 - 2025.07.23 (7506 days)

| Total Gain | 15604205.3% |

| Yearly Gain | 78.9% |

| Monthly Gain | 4.9% |

| Daily Gain | 0.16% |

| Relative Drawdown | 72.3% |

| Profit Factor | 1.6 |

| Currency | USD |

| Final Balance | 78021526.72 |

| Initial Deposit | 500 |

| Total Net Profit | 78021026.72 |

| Total Trades | 2264 |

| Ttimeframe | H1 |

Description

What Is Gold Koala EA

“Gold Koala EA” is an Expert Advisor designed primarily for the 1‑hour chart of XAUUSD. It offers high versatility and adopts an approach aimed at steadily growing even small account sizes. It avoids high‑risk techniques such as Martingale or grid trading, and because it is not a scalping EA, it is not overly sensitive to broker or VPS environments. Additionally, an automatic lot‑size adjustment (compound growth) feature maximizes capital efficiency while keeping risk under control.

Main Features

- No Martingale/Grid: Simple design with capital management as a top priority.

- Not a Scalping EA: Less affected by broker execution speed or server environment.

- Automatic Lot‑Size Adjustment (Compound Growth): Keeps risk constant while automatically increasing lot size as equity grows.

- Symmetrical Buy/Sell Logic: Applies the same pattern for long and short to prevent over‑optimization.

- Optimized for XAUUSD 1‑Hour Chart: Timeframe tailored to gold market characteristics.

- Multi‑Pair Compatibility: Can be applied to other currency pairs by simply changing the symbol in MetaTrader.

Trading Logic Overview

The program consists of two entry patterns, “Logic 1” and “Logic 2,” both of which automate everything from entry to exit using weekly high/low levels and various technical indicators.

Logic 1: Bollinger Bands × ATR Breakout Strategy

Signal Generation

- Detect when the candle open breaks above or below the Bollinger Bands, then wait a set period to capture the pullback timing.

- Reference weekly high/low levels and trigger a stop order at an advantageous level in the trend direction.

Entry Conditions

- Combine multiple factors—such as band width and ATR over a specified look‑back—to refine entries.

- Target the retracement back toward levels once breached, leveraging short‑to‑medium‑term volatility swings.

Risk Management and Exit Settings

- Stop loss and take profit are automatically set at fixed ATR‑based ratios to limit losses on pullbacks.

- ATR‑linked trailing stop supports profit extension.

- Maximum bars held per trade prevent prolonged drawdowns.

Logic 2: ADX Cross × ATR Filter Strategy

Signal Generation

- Use a cross of the ADX +DI and –DI as the trigger, with an ATR threshold filter to narrow entries.

- Capture trend momentum and low‑volatility conditions simultaneously to reduce false signals.

Entry Conditions

- Reference high/low levels over a set period after the cross, placing a stop entry to catch emerging trends.

- Wait for ATR to fall below a specified level, then seize the breakout when volatility returns.

Risk Management and Exit Settings

- Stop loss linked to ATR, take profit set by a simple percentage rule.

- Automatically move stop to breakeven when profit reaches a threshold to protect gains.

- ATR‑based variable trailing stop follows the trend’s potential.

Operational Points

- Weekend Carry‑Over Management: Option to close positions on Friday at a predefined time to control weekend risk.

- VPS/Broker Selection: While high‑execution environments are ideal, the non‑scalping design allows flexible deployment.

Conclusion

Gold Koala EA features two complementary technical strategies optimized for XAUUSD on the 1‑hour chart, capturing trend and volatility in tandem. Its simple, robust capital management—without Martingale, grid, or extreme scalping—combined with high logic versatility makes it an attractive choice. The automatic lot‑size adjustment (compound growth) enables consistent growth from small equity, and the same logic can be applied across multiple currency pairs with ease.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5174) |

||||||||||||

Settings |

||||||||||||

| Expert: | Gold Koala | |||||||||||

| Symbol: | XAUUSD | |||||||||||

| Period: | H1 (2005.01.03 - 2025.07.23) | |||||||||||

| Inputs: | preferredFillingType=0 | |||||||||||

| forceFillingType=false | ||||||||||||

| CustomComment= | ||||||||||||

| MagicNumber1=11111 | ||||||||||||

| MagicNumber2=11112 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=0.4 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 500.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 98% | |||||||||||

| Bars: | 119721 | Ticks: | 24998213 | Symbols: | 1 | |||||||

| Total Net Profit: | 78 021 026.72 | Balance Drawdown Absolute: | 348.15 | Equity Drawdown Absolute: | 350.68 | |||||||

| Gross Profit: | 207 391 590.18 | Balance Drawdown Maximal: | 6 034 150.00 (27.56%) | Equity Drawdown Maximal: | 6 873 600.00 (39.13%) | |||||||

| Gross Loss: | -129 370 563.46 | Balance Drawdown Relative: | 71.78% (3 631 488.06) | Equity Drawdown Relative: | 72.25% (3 690 194.94) | |||||||

| Profit Factor: | 1.60 | Expected Payoff: | 34 461.58 | Margin Level: | 1374.24% | |||||||

| Recovery Factor: | 11.35 | Sharpe Ratio: | 2.55 | Z-Score: | -8.96 (99.74%) | |||||||

| AHPR: | 1.0066 (0.66%) | LR Correlation: | 0.68 | OnTester result: | 0 | |||||||

| GHPR: | 1.0053 (0.53%) | LR Standard Error: | 9 070 584.02 | |||||||||

| Total Trades: | 2264 | Short Trades (won %): | 977 (37.15%) | Long Trades (won %): | 1287 (42.50%) | |||||||

| Total Deals: | 4528 | Profit Trades (% of total): | 910 (40.19%) | Loss Trades (% of total): | 1354 (59.81%) | |||||||

| Largest profit trade: | 3 355 750.00 | Largest loss trade: | -1 462 250.00 | |||||||||

| Average profit trade: | 227 902.85 | Average loss trade: | -94 538.34 | |||||||||

| Maximum consecutive wins ($): | 8 (18 687 400.00) | Maximum consecutive losses ($): | 14 (-2 908.44) | |||||||||

| Maximal consecutive profit (count): | 18 687 400.00 (8) | Maximal consecutive loss (count): | -4 017 750.00 (11) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

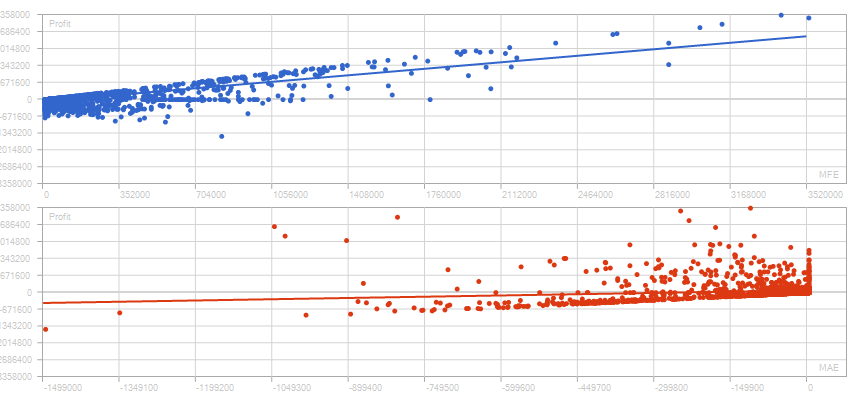

| Correlation (Profits,MFE): | 0.79 | Correlation (Profits,MAE): | 0.15 | Correlation (MFE,MAE): | -0.3247 | |||||||

|

||||||||||||

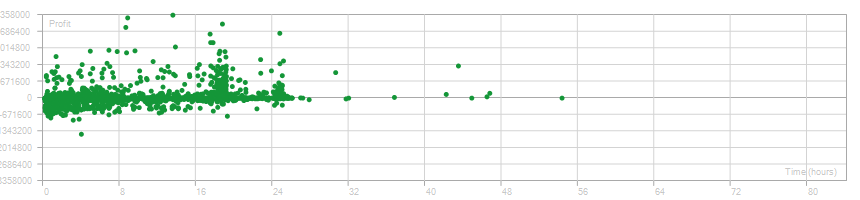

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 54:08:00 | Average position holding time: | 9:19:22 | |||||||

|

||||||||||||

Reviews

There are no reviews yet.