Table of Contents

- Article Aim (Key Points)

- Basics of Monte Carlo Analysis

- Example 1: Gold Crab Robot

- Example 2: “Blind Spots” of Monte Carlo

- Limitations of Monte Carlo Analysis and How to Handle Them

- Practical Checklist

- Common Misunderstandings and Warnings

- Conclusion

Article Aim (Key Points)

Monte Carlo Analysis = Randomly reshuffling win/loss sequences many times to measure the width of worst-case outcomes.

However, it has blind spots: unrealized losses (Equity DD), compounding lot sizes, and long-term price scale changes.

Using Gold Crab Robot and a custom Grid EA as examples, we’ll break down how to read the results and what to watch out for.

Basics of Monte Carlo Analysis

A backtest represents only “one history.”

Monte Carlo creates many alternate histories by reshuffling trade outcomes (resampling), then evaluates distributions of:

- Max Drawdown (MaxDD)

- Final Profit (CAGR equivalent)

- Losing Streaks

- Risk of Ruin

👉 In practice, traders focus on the pessimistic side (e.g., 95% confidence level) to size lots and capital.

Example 1: Gold Crab Robot

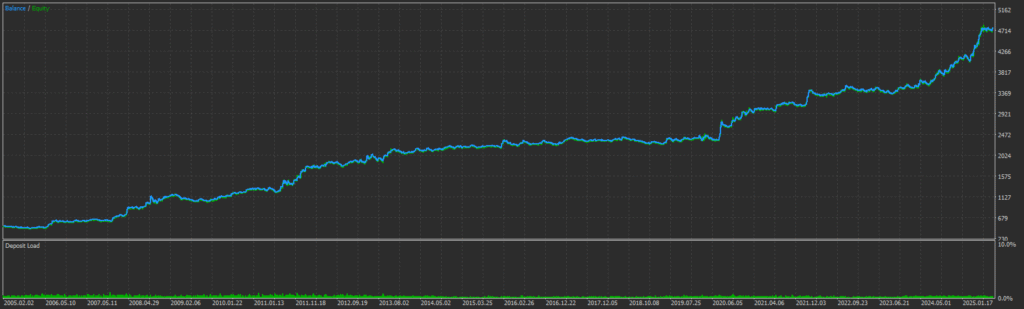

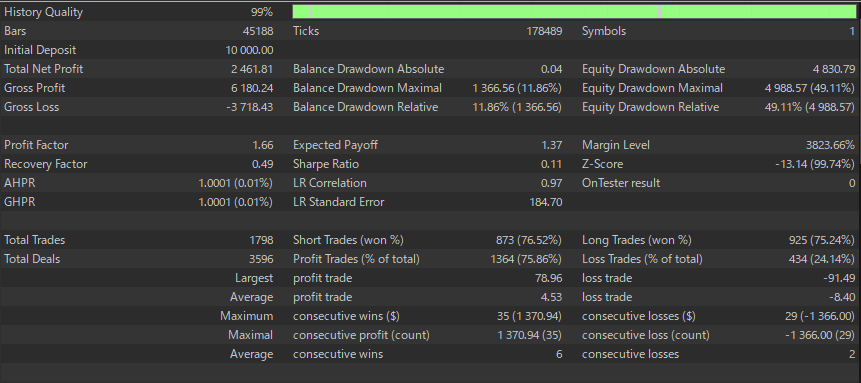

1) Backtest Overview (MT5 Report)

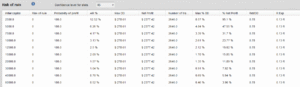

Main Metrics (Excerpt):

- Fixed 0.01 lot, initial deposit $500, total trades 2,999, win rate 40.01%

- Profit Factor 1.45, Sharpe 2.37, Recovery Factor 22.57

- Max Balance DD $179.09 (5.08%), Max Equity DD $192.07 (9.26%)

- Max losing streak 14 (-$43.97), avg. win $11.67, avg. loss -$5.38

👉 First, check the health of raw data (PF, DD, win/loss balance).

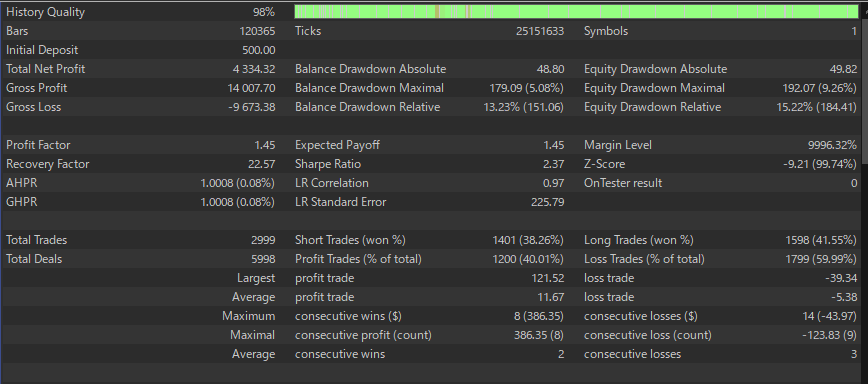

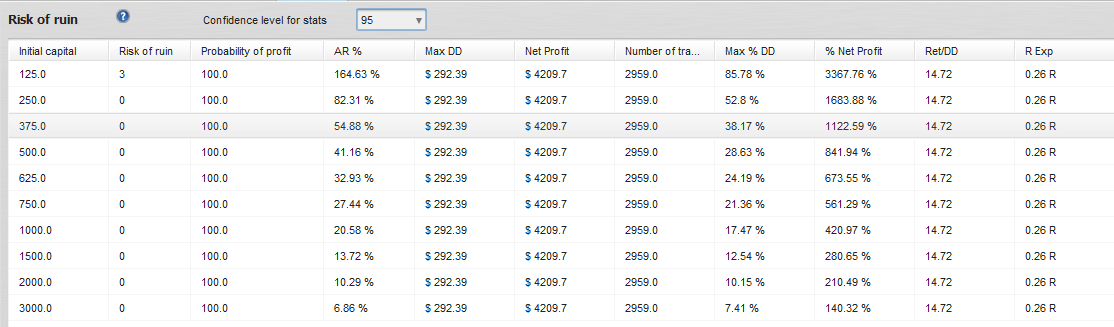

2) Results with Confidence Levels

Reading the 95% row (key):

- Net Profit ≈ $4,209.7 (pessimistic profit expectation)

- Max DD ≈ $292.39, Max %DD ≈ 28.63%

- Ret/DD ≈ 14.72, Max losing streak ≈ 20

Lot sizing examples:

- Allowed DD = 20% → Lot multiplier ≈ 20 / 28.63 ≈ 0.70×

- Allowed DD = 30% → Lot multiplier ≈ 1.05× (still safer to keep ≤1.0×)

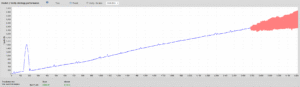

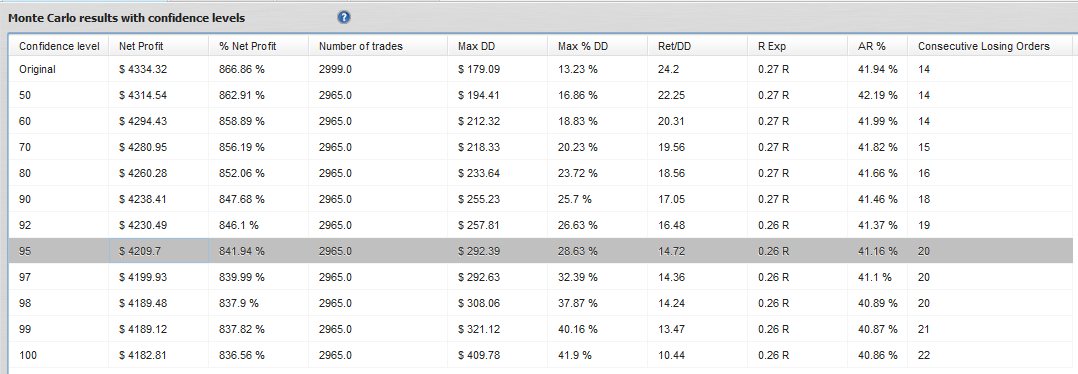

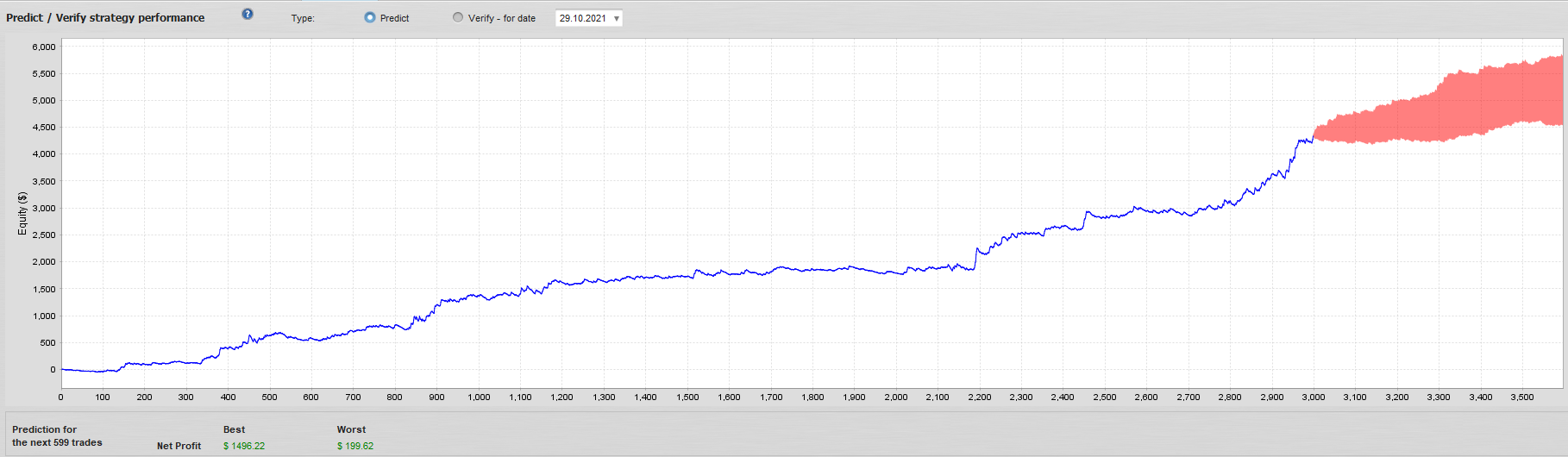

3) Monte Carlo Chart

Key Points:

- Most paths slope upward, but lower-band (pessimistic) curves show dips.

- Safer to size lots based on the lower band.

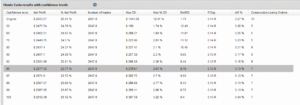

4) Risk of Ruin

Examples:

- Initial balance $125 → Risk of ruin = 3%

- $250+ → 0% (under this model, unlikely to hit ruin zone)

⚠️ But: this assumes fixed lots only. For compounding or margin rules, reassess separately.

5) Predict / Verify (Future Projection)

The red band = projection range for the next X trades.

👉 Practical rule: plan withdrawals and cash flow at the lower bound.

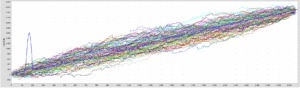

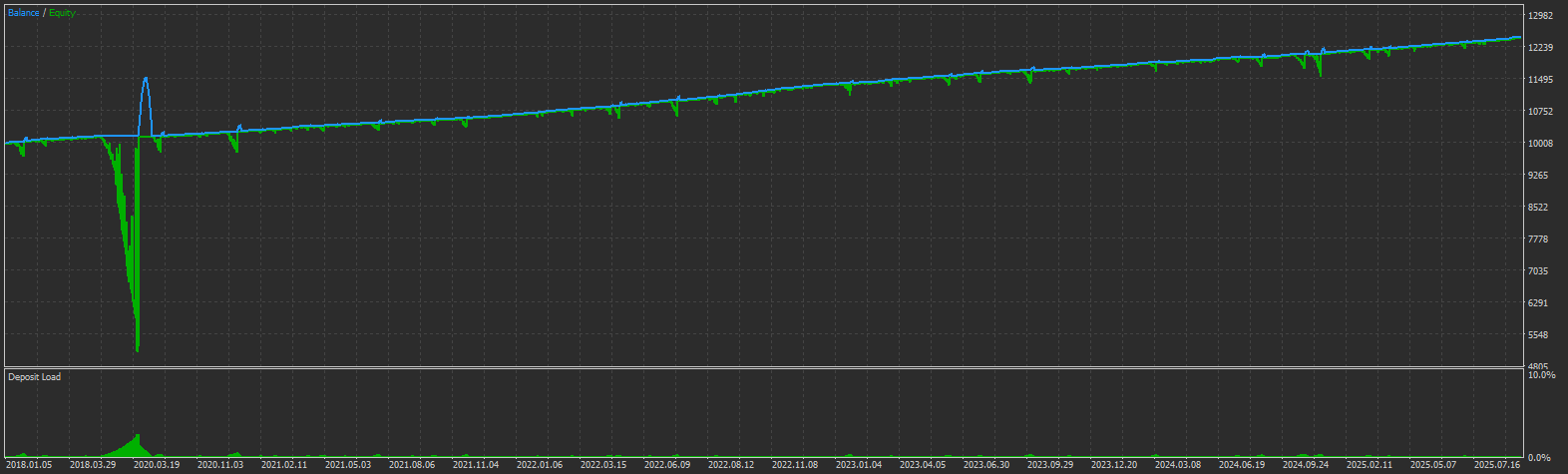

Example 2: “Blind Spots” of Monte Carlo

A) Unrealized Loss Spikes (Equity DD)

In a Sample Grid EA, even with fixed 0.01 lots on a $10,000 account, unrealized losses almost 50% of equity.

➡️ Since Monte Carlo works on closed trades only, it almost ignores such spikes.

B) Why Results Still Look “Good”

Monte Carlo tables and charts can still show:

- Smooth upward curves

- Low Max %DD values

👉 But risks like equity drawdown and margin exposure remain hidden. For Grid/Martingale EAs, this blind spot can be fatal.

Limitations of Monte Carlo Analysis and How to Handle Them

1) Equity DD not included

MC resamples closed trades → can’t capture large unrealized losses or margin calls.

Solutions:

- Use equity-based returns if tool supports.

- Monitor Max Equity DD, Margin Usage, MAE separately.

- Prioritize external monitoring for Grid/Martingale.

2) Not suited for compounding (variable lots)

MC assumes fixed lots. Balance-linked lots distort risk if just reshuffled.

Solutions:

- Evaluate compounding via EA backtest directly.

- If needed, resample % returns then apply compounding afterward (sensitive to assumptions).

3) Long-term price scale changes

XAUUSD ↑10× in 20 years, USDJPY ↑2×.

Fixed pip rules over decades distort results.

Solutions:

- Normalize by % returns or ATR multiples.

4) Streak dependence (autocorrelation)

Simple shuffle breaks winning/losing clusters.

Solutions: Use block bootstrap (5–20 trades) or regime-based resampling.

Practical Checklist

- Choose confidence level (e.g., 95%).

- Lot sizing: Allowed DD / Max %DD(95%) (≈28.63% for Gold Crab).

- Initial capital: where Risk of Ruin = 0–1% (fixed lots).

- Losing streak tolerance: plan for ≈20 consecutive losses.

- Monitor separately: Equity DD, margin usage, MAE.

- OOS / Forward tests: don’t mix with optimization period.

- Logic robustness: check for Grid/Martingale, abnormal win rates, poor RR.

Common Misunderstandings and Warnings

- Smooth MC bands ≠ safe system. Grid/Martingale risks show up on equity, not in MC.

- MC screenshots can be “authority decoration.” Some vendors show them to fake safety. True reliability comes from:

- Forward tests

- Robust, universal logic

- Avoiding over-optimization

Conclusion

Monte Carlo Analysis is a valuable tool to visualize closed-trade order risk and guide lot sizing & capital planning.

But its blind spots (Equity DD, compounding, price scaling) require separate monitoring.

👉 Don’t trust Monte Carlo alone—the real core is strategy logic robustness: forward/OOS testing, avoiding curve-fitting, and ensuring no reliance on Grid/Martingale.

For more information, please see the related article below.

Stop Chasing Win Rate: Expectancy & Risk-Reward (RR) for Choosing EAs

Avoid Overfitted EAs: A Pre-Purchase Checklist

Walk-Forward Analysis for EA Buyers: Trust Beyond Backtests