What Is Leverage in Forex?

Leverage lets you control a larger notional position using your own funds (margin) as collateral. The key insight: your P&L is driven by lot size and stop distance, not by the leverage number itself. Leverage primarily affects required margin (free margin/room).

Margin Formula

- Required Margin ≈ Notional Value ÷ Leverage

- Notional Value = Lots × Contract Size (e.g., 1 lot = 100,000 units) × Price

Worked Example (EURUSD 0.10 lot @ 1.1000)

- Notional:

0.1 × 100,000 × 1.1000 = 11,000 USD - Leverage 1:1 → Required margin = 11,000 USD

- Leverage 25:1 → 440 USD

- Leverage 500:1 → 22 USD

Same lot, same P&L. Higher leverage only reduces the required margin and increases free margin; it doesn’t change profit/loss per pip.

Ultra-Extreme Illustration

At 500:1, you can hold 0.10 lot with just 22 USD in margin. If your account balance is only 30 USD, your free margin is ~8 USD. For 0.10 lot on EURUSD, 1 pip ≈ 1 USD, so a move of about 8 pips against you can exhaust your free margin and approach margin-closeout (exact thresholds vary by broker). Balance the margin and lot size—that’s what truly matters.

Same Lot, Same Outcome — A Mini Experiment

- Account balance: $5,000

- Risk per trade: 1% = $50

- Stop distance: 50 pips, pip value: $1/pip → 0.10 lot

With these settings, a stop-out loses $50 whether leverage is 25:1 or 500:1. The only difference is required margin (free margin). The danger is psychological: more free margin can tempt you to over-position. Enforce rules for max simultaneous positions and lot caps. For discipline, systematic trading (EA) can automate position and lot-size controls.

“Higher Leverage Is Dangerous” — Myth vs Reality

- Myth: Simply increasing leverage is inherently dangerous.

- Reality: What makes trading dangerous is excessive lot size, not the leverage number itself.

- Correct view: If you can control lot size, higher leverage = better margin efficiency and flexibility. Risk is set by lot size and the stop-loss.

- Bottom line: Raising leverage without raising lot size keeps risk the same, while expanding options for diversification and hedging.

When High Leverage Tends to Be Risky

- Weekend gaps: A gap can jump over your stop and create losses beyond expectations, potentially leading to a negative balance.

- Over-sizing: High leverage enables large or multiple positions; if a large gap hits, losses can compound quickly.

- Zero-balance/negative-balance policies: Protection and margin-closeout levels differ by region and broker.

Typical Regulatory Baselines (Always Re-check)

- EU (ESMA): Majors ~30:1; minors/gold/major indices ~20:1; negative balance protection is standard for retail.

- Japan (FSA/FFAJ): Margin requirement ≥4% (≈≤25:1) and mandatory stop-out rules; negative balance protection is not uniformly mandated.

- Australia (ASIC): Majors ~30:1 (since 2021).

- US (CFTC/NFA): Majors 50:1, others 20:1; negative balance protection is not a regulatory requirement.

Conversely, some global brokers operating under licenses such as CySEC, Cayman, Seychelles FSA offer higher leverage like 1:500, 1:1000, or even no explicit cap. Always verify current terms and regulations directly with the broker/regulator.

Practical Defenses

- Reduce or avoid weekend exposure.

- Design for max loss caps that include potential gaps.

- Keep ample free margin to absorb volatility.

How to Think About Leverage in Practice (Beginner’s Guide)

Position-Size First

- Set risk per trade (e.g., 0.5–1.0% of equity).

- Define stop distance.

- Compute lot size so the worst-case loss ≦ risk.

- Check required margin and keep sufficient free margin.

Alternatively, use a long backtest to estimate max drawdown and size the balance/lot ratio accordingly.

Prioritize Risk–Reward and Win Rate

If your strategy enforces stop-losses and achieves a healthy risk–reward, you generally don’t need a high account leverage to perform well.

Manage Weekend/News Exposure

Reduce carry over the weekend, trim size around key events, or hedge appropriately.

EA and Leverage: How to Assess Safety

- With a disciplined EA (robust SL, good RR), 1:25 vs 1:2000 typically yields similar outcomes at the same lot size—low leverage dependence is a healthy sign.

- EA marketing that stresses “high leverage required” often implies grid/martingale logic—strategies that rely on many/add-on positions and large lots, and that tend to fail under low leverage.

Questions to Ask the Vendor

- Minimum required leverage? (The higher it is, the more cautious you should be.)

- Is a stop-loss always in place? What loss is expected under gaps, and how do you recover?

- Weekend rules? Is negative balance protection assumed?

All EAs featured on our site are designed to run even at low leverage (e.g., 1:25), thanks to RR-first logic plus SL and weekend-close rules that reduce leverage dependence.

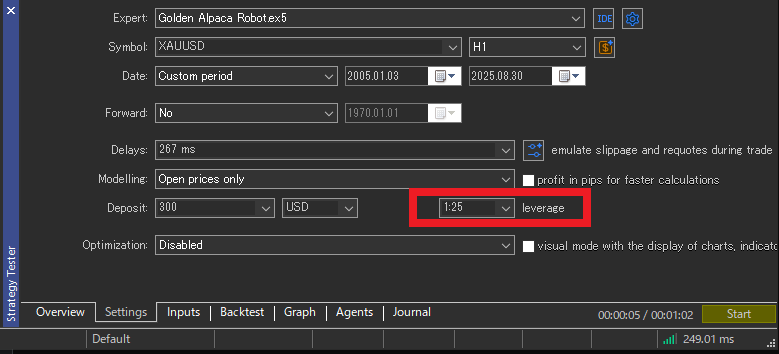

MT5 Backtest Notes

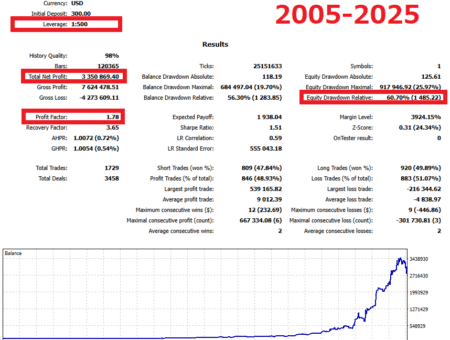

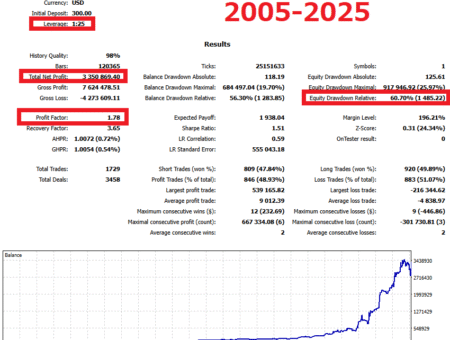

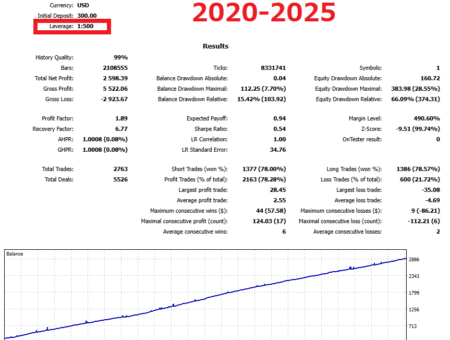

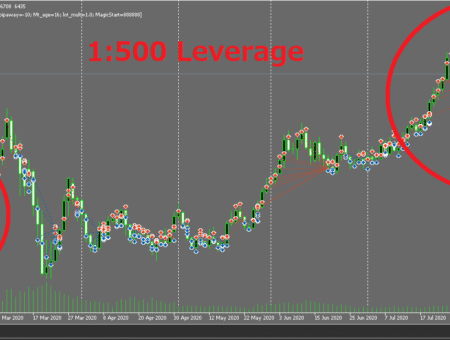

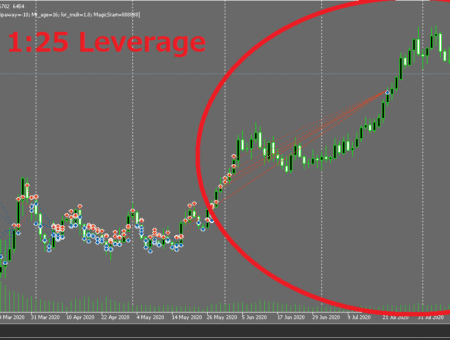

MT5’s Strategy Tester lets you set the test leverage to see how results change. For example, using Gold Alpaca Robot with identical conditions at 1:25 and 1:500 (UseMoneyManagement=true; mmRiskPercent=1.5), the main stats matched:

- Initial Deposit: $300

- Total Net Profit: $3,350,869

- Profit Factor: 1.78

- Equity Drawdown (Relative): 60.70%

Raising mmRiskPercent to 2.0 caused leverage limits to cap lot size, reducing both net profit and drawdown. In other words, leverage can sometimes act as a risk governor that prevents over-sizing.

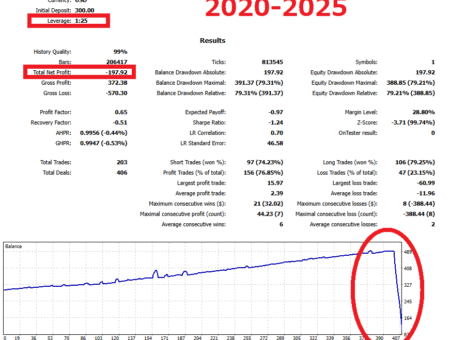

Grid/Martingale Warnings

With a sample grid EA, backtests at 1:500 might look smooth, but at 1:25 the system can stall and stop out when it can no longer add positions.

These strategies assume add-ons and large sizing, so they often require high leverage to function—an important red flag for risk.

FAQ

Q1. Is high leverage actually dangerous?

A. It becomes dangerous when you increase lot size, not when you increase leverage per se. If you keep lot size fixed and follow rules, the benefits of flexibility and margin efficiency can outweigh the downsides.

Q2. Is negative balance protection identical everywhere?

A. It’s standard for EU retail, but not uniformly mandated in Japan or the US. Always confirm in the broker’s terms.

Q3. What maximum leverage should a beginner choose?

A. If you can uphold “high leverage × low lot,” a high-leverage account is fine. If unsure, start under stricter regimes (e.g., EU 30:1 or Japan 25:1) to act as a built-in safety device.

Q4. What should I prioritize for EA trading?

A. Minimum required leverage, SL enforcement, RR, weekend rules, and expected drawdown. “High leverage required” is often a grid/martingale tell.

Summary

- Leverage itself isn’t “dangerous”—lot sizing is.

- Gap and negative-balance risks vary by region and broker—read the latest terms.

- Healthy EAs work at low leverage; “high leverage required” is a caution flag.