Article Goal

Many traders experience this problem: their strategy wins in backtests but fails in live trading.

A common reason is that trading costs are not properly accounted for.

To bridge the gap, you need to understand the three key costs in Forex—spread, commission, and slippage—and reflect them accurately in your testing before evaluating a strategy.

The Three Core Trading Costs

- Spread: The difference between the bid and ask price. It’s a fixed cost that puts you in a loss immediately after entering a trade.

- Commission: A per-trade fee, most common in low-spread/ECN accounts.

- Slippage: The difference between the expected price and the actual execution price, often seen in fast-moving or thin markets.

Total cost (in pips) = Spread + Average Slippage + Commission (converted into pips)

How to Check Each Cost

Spread

- Brokers often advertise “minimum spreads” (e.g., 0.0 pips), but this does not reflect actual conditions.

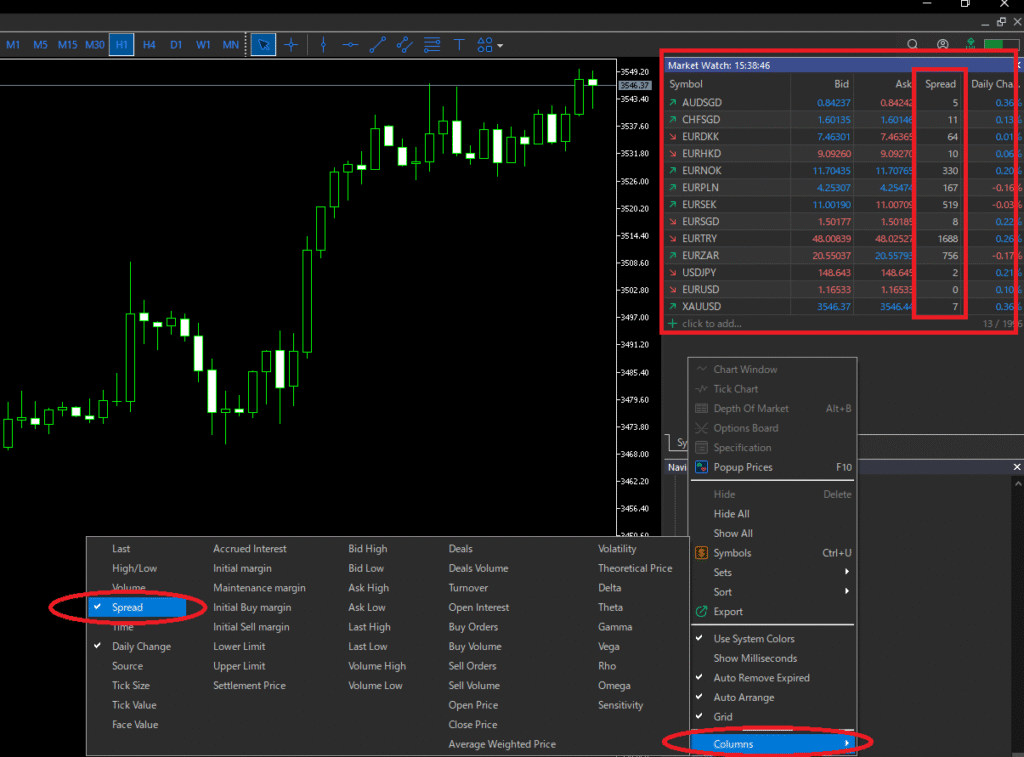

- On MT5, you can check real-time spreads in the Market Watch window. Right-click on the “Market Watch” window in MT5, and check “Spread” in the “Columns” section to display the spread.

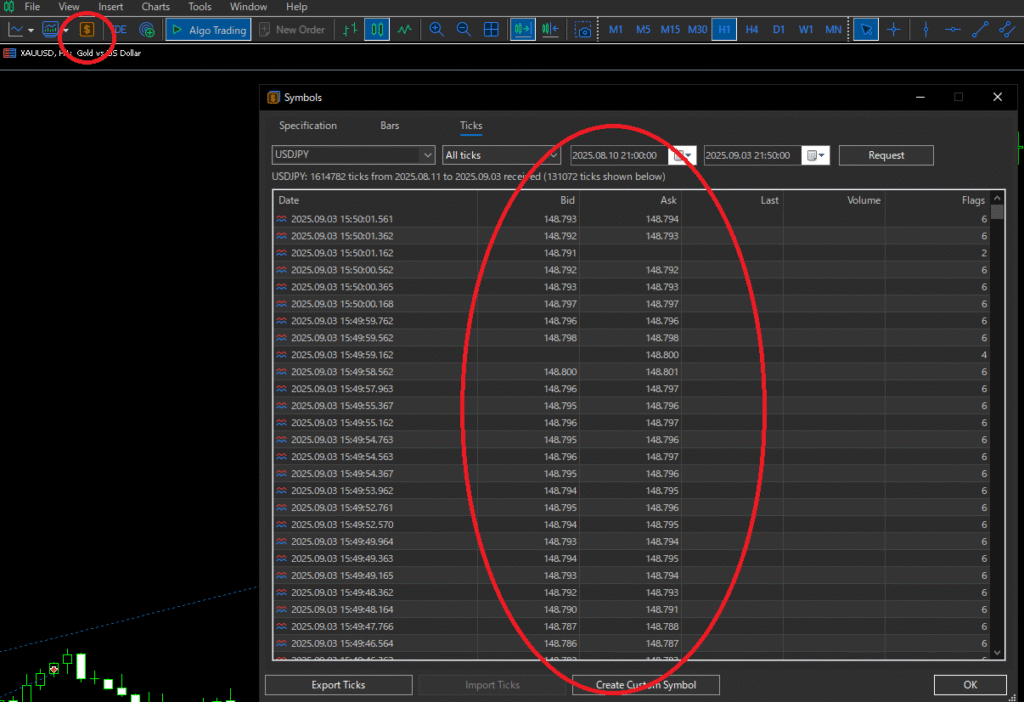

- For realistic evaluation, observe Bid/Ask differences in the 1-minute or tick data, then calculate averages by time of day.

Commission

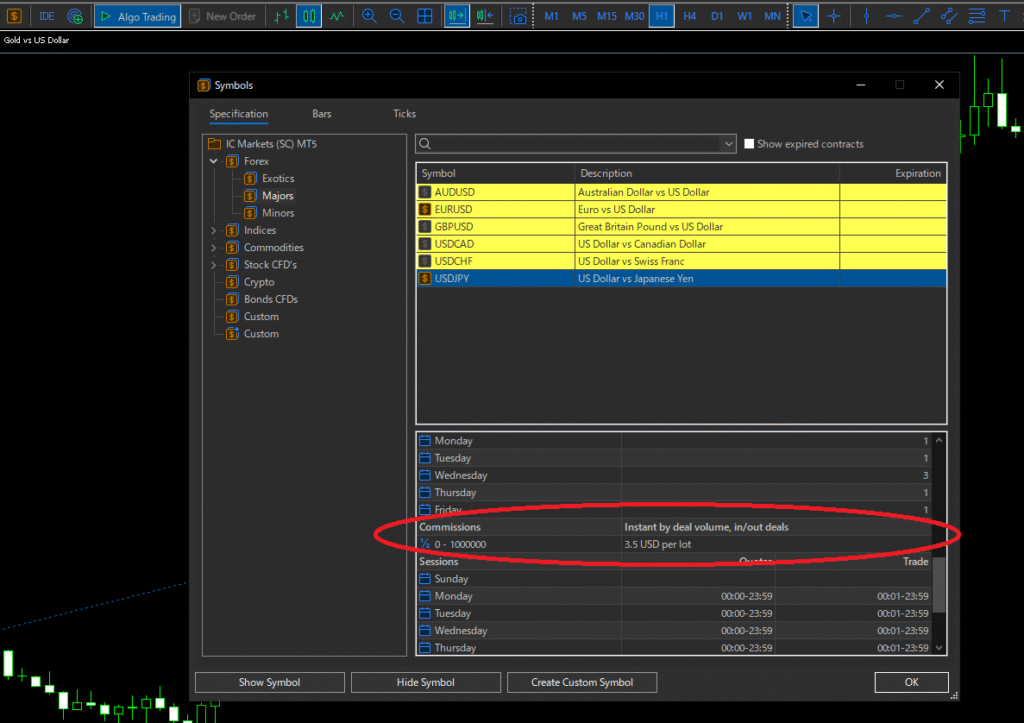

- Published on the broker’s website or inside MT5 under “Contract Specifications.”

- Always calculate round-trip costs (e.g., $3.5 per side = $7 per round).

Slippage

- Easier to measure on stop/limit orders (difference between order price and execution price).

- Market orders are harder but can be estimated by checking execution logs or comparing with immediate ticks.

Account Types: Standard vs. Low-Spread

Standard Account (no commission, wider spread)

Pros

Simple, only the spread matters; easy to calculate, especially for small lots or infrequent trades.

Cons

Wider spreads hurt short-term or high-frequency strategies. Spreads may widen further in volatile conditions.

Best for

Traders who prefer simplicity; swing or low-frequency trading.

Low-Spread Account (with commission, tight spread)

Pros

Lower overall costs during normal conditions; well-suited for short-term or high-frequency trading.

Best for

Traders focused on reducing costs as much as possible.

Which to choose?

- Swing traders with fewer trades and larger targets can do fine with standard accounts.

- Generally, low-spread accounts result in lower costs, so unless you have a special reason, they are recommended.

- Final decision: compare monthly trade count × actual costs (in pips) between account types.

Two Types of Slippage

- Negative Slippage: Execution worse than requested (buy higher, sell lower). Increases cost.

- Positive Slippage: Execution better than requested (buy lower, sell higher). Reduces cost.

- In practice, negative slippage occurs more often, especially around news, gaps, or low-liquidity times.

- In backtests, always assume negative slippage for safety.

When Costs Increase (Time & Events)

- London–New York overlap: spreads are usually tightest.

- Rollover time (server midnight, GMT+2/+3): spreads often widen for several minutes.

- Week open/close: beware of gaps and wide spreads.

- Major economic releases (CPI, NFP, FOMC): spreads expand and slippage worsens.

Practical tip: Use rules like “no new trades during news or rollover” or add spread filters in your EA.

Note: Some strategies purposely trade during news, so align rules with your strategy design.

Converting Commissions into Pips

To evaluate costs fairly, convert commissions into pips:

Cost converted to pips = Spread + Average Slippage + (Round-trip Commission ÷ (Pip Value × Lot Size))

Example (EURUSD, 1 lot, pip value = $10, round-trip commission = $7):

- Spread = 1.2 pips, Average Slippage = 0.3 pips → 1.5 pips

- Commission in pips = $7 ÷ ($10 × 1) = 0.7 pips

- Cost converted to pips = 1.5 + 0.7 = 2.2 pips

If your average trade profit is below 2.2 pips, the strategy is unlikely to be profitable.

In real trading, add +0.2–0.5 pips for safety due to rejections or execution variance.

Aligning Backtests with Live Trading

- Spread: assume variable, and set slightly wider than the broker’s minimum.

- Commission: use the broker’s actual round-trip per lot value.

- Slippage: add 0.1–0.3 pips to simulate; block new trades during major events.

Only trust strategies that remain positive under pessimistic assumptions.

Related article: Backtest Quality 99%: Meaning, Settings & Limits

Demo vs. Live Accounts

- Execution environments differ between demo and live.

- Many EAs show profits on demo but underperform in live due to slippage and liquidity differences.

- Always prioritize real account results when evaluating a strategy.

Avoiding Overly Cost-Sensitive EAs

- If an EA only works under optimistic costs or only on demo, it is too sensitive to trading costs.

- Scalping EAs often fall into this category.

- How to avoid: check whether the vendor publishes verified live results and whether results are consistent across accounts.

Summary

- Trading costs = Spread + Commission + Slippage. Always calculate them in pips.

- Build backtests with pessimistic costs to avoid surprises in live trading.

- Be cautious with scalping EAs; they are highly cost-sensitive.

- For evaluation, prioritize real account results over backtests or demos.