Live Performance Full Result with Myfxbook

Failed to retrieve image data.

| Total Gain | 8% |

| Daily Gain | 0.05% |

| Monthly Gain | 2% |

| Drawdown | 6% |

| Profit Factor | 1.38 |

| Total Pips | 213.4pips |

| Account Currency | USD |

| Deposit | $ 300 |

| Profit | $ 25.2 |

| Balance | $ 325.2 |

| Equity | $ 325.2 |

| Swap | $ -1.32 |

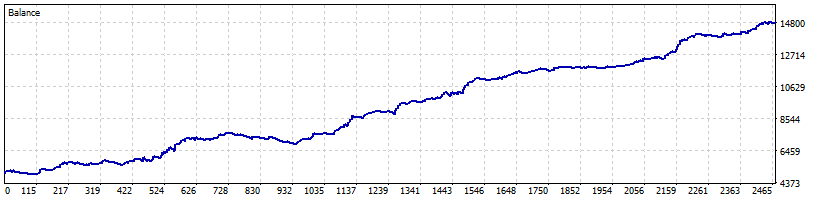

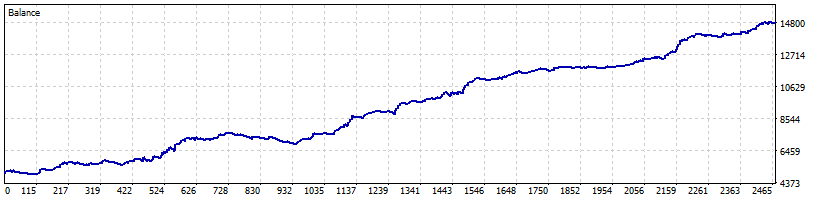

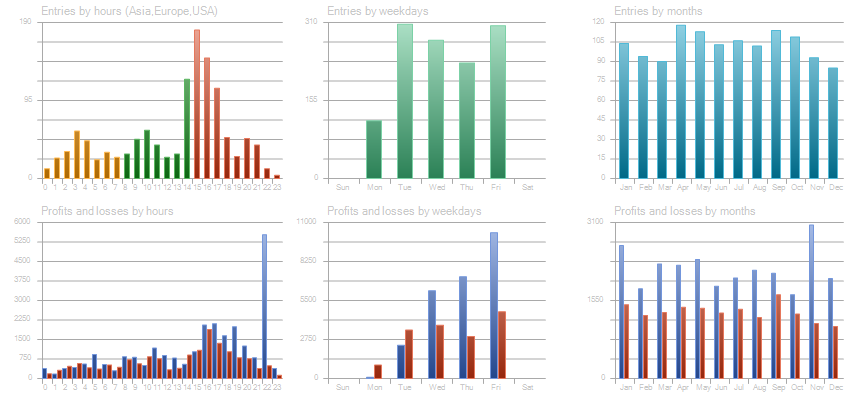

Backtesting

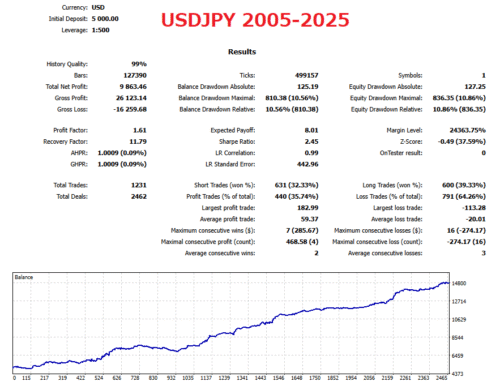

| Total Gain | 197.3% |

| Yearly Gain | 5.4% |

| Monthly Gain | 0.4% |

| Daily Gain | 0.01% |

| Relative Drawdown | 10.9% |

| Profit Factor | 1.61 |

| Currency | USD |

| Final Balance | 14863.46 |

| Initial Deposit | 5000 |

| Total Net Profit | 9863.46 |

| Total Trades | 1231 |

| Timeframe | H1 |

![]() MetaTrader 5 (MT5)

MetaTrader 5 (MT5)

- Works even with low leverage (1:25, 1:30, etc.)

- No Martingale, no Grid, no Scalping

- Low-risk strategy with an excellent Risk-Reward Ratio (RR)

- Verified with forward testing on real accounts

- Verified with backtesting over 20+ years

Description

Product Overview

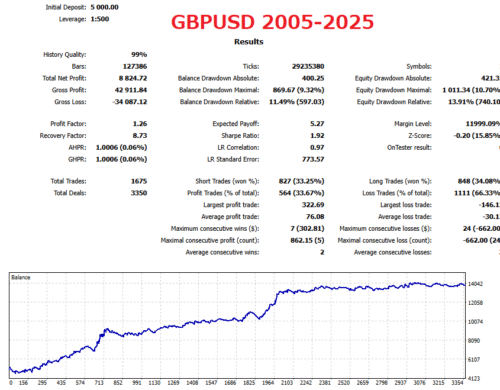

This EA works on USDJPY, GBPUSD, and EURUSD 1‑hour charts with exactly the same trading logic. By running with identical parameters across multiple major pairs, it avoids over‑optimization and is designed to adapt to diverse market conditions.

Main Features

- High Versatility

Applies the same logic to USDJPY, GBPUSD, and EURUSD 1‑hour charts without modification. - Risk‑First Design

Caps per‑trade risk to enable stable control even with small account sizes. - Individual Stop‑Loss

Every position is protected by its own stop‑loss to guard against sudden spikes. - No Martingale or Grid

Eliminates methods that inflate risk, preventing excessive drawdowns over long runs. - Auto Lot Sizing (Compounding)

Automatically adjusts lot sizes to incorporate gains, supporting efficient growth from small capital. - Not a Scalper

Designed for daily trading, less sensitive to spreads or execution environment. - Symmetrical Buy/Sell Logic

Identical entry/exit criteria for long and short to avoid bias and over‑fitting.

Trading Logic Overview

The EA looks for moments when all three of the following conditions align:

- StdDev shows a turning point in price dispersion

- ADX DI lines signal a trend reversal

- ATR‑based volatility percentage is within defined bounds

Combining these signals, it automatically issues stop orders adjusted for recent channel expansion. Profit targets and stop‑losses are managed in percentage terms, with optional break‑even moves and timed exits.

Logic Benefits

- Highly Adaptive

Monitors both volatility and trend flips to handle quiet ranges and sudden moves; ATR filters reduce unnecessary entries even during spikes. - Prevents Over‑Optimization

Using identical parameters on three major pairs avoids curve‑fitting to specific historical data, ensuring consistent live performance. - Robust Risk Control

Individual stop‑loss per trade limits unexpected drawdowns; compounded auto‑lot sizing maintains risk at each step. - Improved Entry Precision

Combines StdDev turns, ADX DI crosses, and ATR percent rank to filter false signals and capture trend beginnings more reliably. - Automated & Flexible

Features break‑even moves and bar‑count exits to minimize hands‑on monitoring; continuous operation without weekend stops.

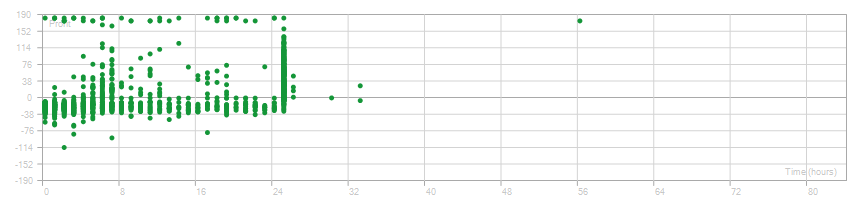

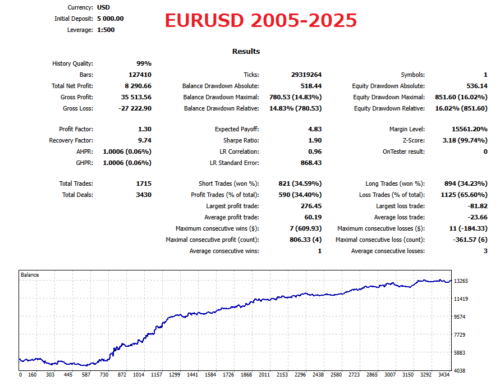

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5147) |

||||||||||||

Settings |

||||||||||||

| Expert: | Colorful Long-tailed Tit | |||||||||||

| Symbol: | USDJPY | |||||||||||

| Period: | H1 (2005.01.03 - 2025.07.23) | |||||||||||

| Inputs: | MagicNumber=11111 | |||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=false | ||||||||||||

| mmRiskPercent=1.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.1 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=22:00 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 5 000.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 127390 | Ticks: | 499157 | Symbols: | 1 | |||||||

| Total Net Profit: | 9 863.46 | Balance Drawdown Absolute: | 125.19 | Equity Drawdown Absolute: | 127.25 | |||||||

| Gross Profit: | 26 123.14 | Balance Drawdown Maximal: | 810.38 (10.56%) | Equity Drawdown Maximal: | 836.35 (10.86%) | |||||||

| Gross Loss: | -16 259.68 | Balance Drawdown Relative: | 10.56% (810.38) | Equity Drawdown Relative: | 10.86% (836.35) | |||||||

| Profit Factor: | 1.61 | Expected Payoff: | 8.01 | Margin Level: | 24363.75% | |||||||

| Recovery Factor: | 11.79 | Sharpe Ratio: | 2.45 | Z-Score: | -0.49 (37.59%) | |||||||

| AHPR: | 1.0009 (0.09%) | LR Correlation: | 0.99 | OnTester result: | 0 | |||||||

| GHPR: | 1.0009 (0.09%) | LR Standard Error: | 442.96 | |||||||||

| Total Trades: | 1231 | Short Trades (won %): | 631 (32.33%) | Long Trades (won %): | 600 (39.33%) | |||||||

| Total Deals: | 2462 | Profit Trades (% of total): | 440 (35.74%) | Loss Trades (% of total): | 791 (64.26%) | |||||||

| Largest profit trade: | 182.99 | Largest loss trade: | -113.28 | |||||||||

| Average profit trade: | 59.37 | Average loss trade: | -20.01 | |||||||||

| Maximum consecutive wins ($): | 7 (285.67) | Maximum consecutive losses ($): | 16 (-274.17) | |||||||||

| Maximal consecutive profit (count): | 468.58 (4) | Maximal consecutive loss (count): | -274.17 (16) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 3 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

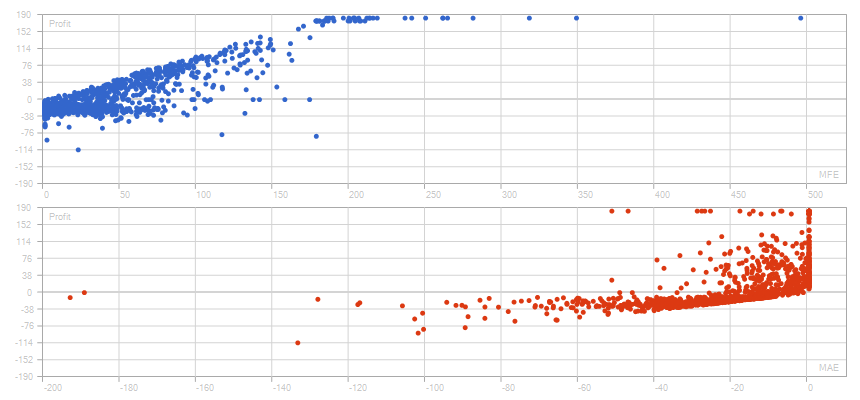

| Correlation (Profits,MFE): | 0.86 | Correlation (Profits,MAE): | 0.52 | Correlation (MFE,MAE): | 0.3189 | |||||||

|

||||||||||||

| Minimal position holding time: | 0:00:01 | Maximal position holding time: | 55:59:59 | Average position holding time: | 11:05:16 | |||||||

|

||||||||||||

General Inquiries

There are no inquiries yet.

Ask a Question

Reviews

There are no reviews yet.