Live Performance Full Result with Myfxbook

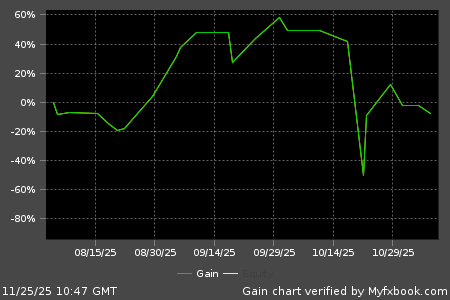

| Total Gain | 50% |

| Daily Gain | 0.54% |

| Monthly Gain | 20% |

| Drawdown | 19% |

| Profit Factor | 2.01 |

| Total Pips | 16224pips |

| Account Currency | USD |

| Deposit | $ 300 |

| Profit | $ 148.82 |

| Balance | $ 448.82 |

| Equity | $ 448.82 |

| Swap | $ -13.42 |

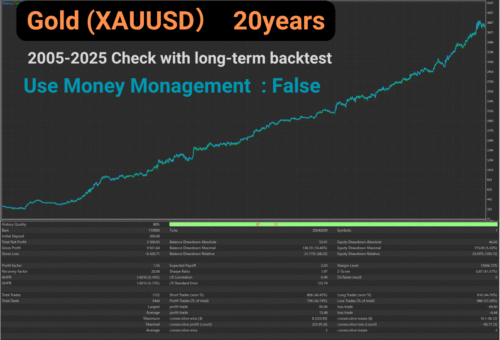

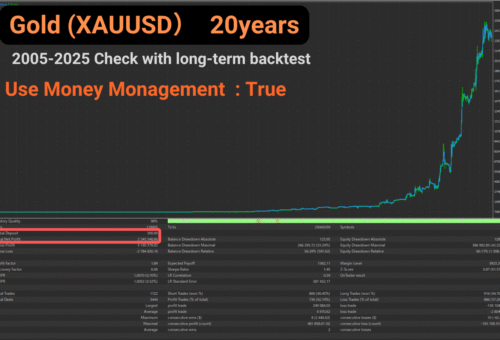

Backtesting

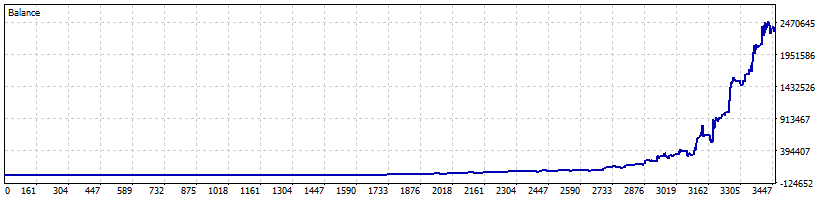

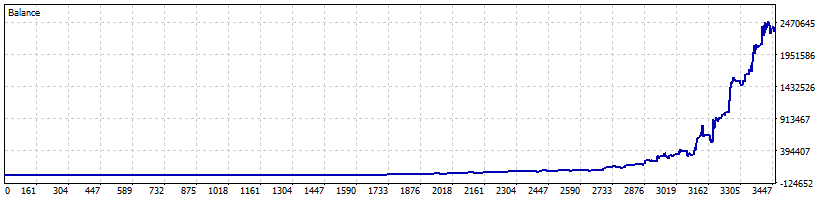

| Total Gain | 781849.6% |

| Yearly Gain | 54.5% |

| Monthly Gain | 3.6% |

| Daily Gain | 0.12% |

| Relative Drawdown | 60.1% |

| Profit Factor | 1.84 |

| Currency | USD |

| Final Balance | 2345848.86 |

| Initial Deposit | 300 |

| Total Net Profit | 2345548.86 |

| Total Trades | 1722 |

| Timeframe | H1 |

![]() MetaTrader 5 (MT5)

MetaTrader 5 (MT5)

- Works even with low leverage (1:25, 1:30, etc.)

- No Martingale, no Grid, no Scalping

- Low-risk strategy with an excellent Risk-Reward Ratio (RR)

- Verified with forward testing on real accounts

- Verified with backtesting over 20+ years

Description

Golden Alpaca Robot – XAUUSD H1 自動交易EA

「Golden Alpaca Robot」是一款針對黃金(XAUUSD)H1圖表進行優化的專家顧問(EA)。即使在資金較少的情況下,它也旨在控制風險的同時捕捉重要機會。以下是分為邏輯1和邏輯2的概述。

■ 主要特色

- 無馬丁格爾或網格交易

避免了部位規模調整策略所帶來的風險擴大,實現更穩定的交易。 - 非剝頭皮交易EA

採用對券商或環境條件不那麼敏感的量化進場和出場標準。 - 自動手數調整(複利)

根據帳戶餘額動態調整部位大小,支援從小資金開始成長。 - 對稱的多/空邏輯

買入和賣出應用相同的規則,以防止過度優化。

■ 交易邏輯1:趨勢 + 波動擴展訊號

1. 趨勢確認(移動平均線交叉)

- 在主H1圖表上,檢查加權移動平均線(WMA)和簡單移動平均線(SMA)的方向。

- 透過確認ATR正在上升來評估趨勢強度。

2. 進場價位設置

- 結合最近高點/低點範圍和最小範圍寬度,放置止損訂單。

- 動態計算進場的「允許距離」,以適應突發市場變動。

3. 止損與獲利目標管理

- 使用ATR和Keltner Channel數值自動確定止損水平。

- 設定固定比例的獲利目標,並在適當時進行保本追蹤。

4. 訂單有效性管理

- 讓進場訂單保持活躍數十個K線,然後優先考慮新訊號。

- 透過週末和特定時間限制來抑制不必要的部位。

■ 交易邏輯2:反轉 & 帶狀突破訊號

1. 振盪指標與帶狀區檢測

- 使用H1圖表上的布林帶(Bollinger Bands)檢測「突破」區域。

- 將Vortex指標的趨勢方向與下降的ATR相結合。

2. 反轉進場

- 當價格跌破下軌時等待多頭的止損訂單,當價格突破上軌時等待空頭的止損訂單。

- 在價格移動指定的點數距離後設置執行點。

3. 追蹤止損應用

- 使用基於ATR的追蹤止損,當價格有利地移動時鎖定未實現的收益。

- 在捕捉反轉後趨勢的同時將損失降至最低。

「Golden Alpaca Robot」透過動態風險管理和多維度訊號確認,在XAUUSD上實現穩定的自動交易。它避免了對剝頭皮交易、馬丁格爾或網格方法的依賴,採用最小化損失抑制和利潤追蹤來實現長期運作的設計。

Meta description: Golden Alpaca Robot 是一款專為黃金 (XAUUSD) H1 圖表設計的自動交易EA。了解其無馬丁格爾、無網格交易,以及如何透過獨特的雙重邏輯,實現風險控制與穩定獲利。

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 5200) |

||||||||||||

Settings |

||||||||||||

| Expert: | Golden Alpaca Robot | |||||||||||

| Symbol: | XAUUSD | |||||||||||

| Period: | H1 (2005.01.03 - 2025.08.02) | |||||||||||

| Inputs: | MagicNumber1=11111 | |||||||||||

| MagicNumber2=11112 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=1.5 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.01 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:40 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 300.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 98% | |||||||||||

| Bars: | 119905 | Ticks: | 25042039 | Symbols: | 1 | |||||||

| Total Net Profit: | 2 345 548.86 | Balance Drawdown Absolute: | 123.95 | Equity Drawdown Absolute: | 128.81 | |||||||

| Gross Profit: | 5 130 379.02 | Balance Drawdown Maximal: | 266 295.72 (33.24%) | Equity Drawdown Maximal: | 386 992.85 (42.22%) | |||||||

| Gross Loss: | -2 784 830.16 | Balance Drawdown Relative: | 56.39% (597.62) | Equity Drawdown Relative: | 60.11% (1 308.03) | |||||||

| Profit Factor: | 1.84 | Expected Payoff: | 1 362.11 | Margin Level: | 3923.31% | |||||||

| Recovery Factor: | 6.06 | Sharpe Ratio: | 1.45 | Z-Score: | 0.87 (61.57%) | |||||||

| AHPR: | 1.0070 (0.70%) | LR Correlation: | 0.59 | OnTester result: | 0 | |||||||

| GHPR: | 1.0052 (0.52%) | LR Standard Error: | 387 452.17 | |||||||||

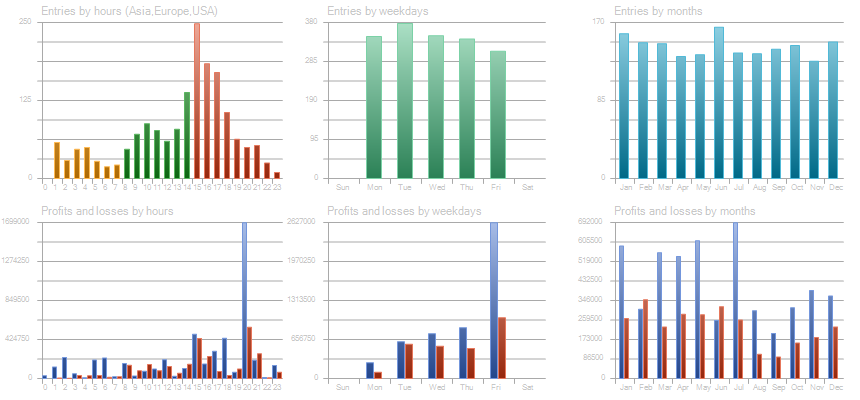

| Total Trades: | 1722 | Short Trades (won %): | 806 (40.45%) | Long Trades (won %): | 916 (44.76%) | |||||||

| Total Deals: | 3444 | Profit Trades (% of total): | 736 (42.74%) | Loss Trades (% of total): | 986 (57.26%) | |||||||

| Largest profit trade: | 249 084.03 | Largest loss trade: | -136 104.67 | |||||||||

| Average profit trade: | 6 970.62 | Average loss trade: | -2 804.98 | |||||||||

| Maximum consecutive wins ($): | 8 (2 440.63) | Maximum consecutive losses ($): | 10 (-62.60) | |||||||||

| Maximal consecutive profit (count): | 481 858.61 (6) | Maximal consecutive loss (count): | -165 109.10 (3) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 2 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

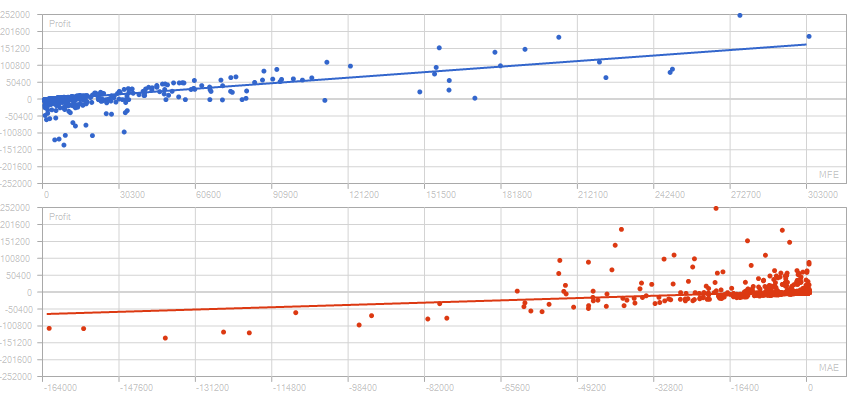

||||||||||||

| Correlation (Profits,MFE): | 0.74 | Correlation (Profits,MAE): | 0.29 | Correlation (MFE,MAE): | -0.2837 | |||||||

|

||||||||||||

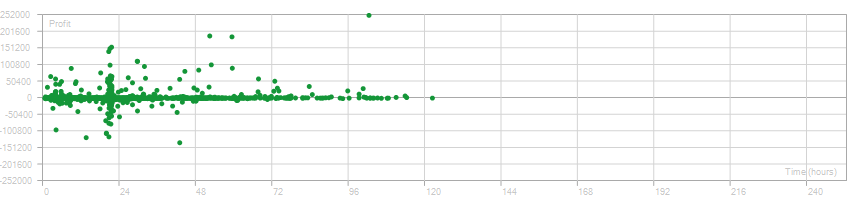

| Minimal position holding time: | 0:00:40 | Maximal position holding time: | 121:41:00 | Average position holding time: | 22:05:33 | |||||||

|

||||||||||||

General Inquiries

There are no inquiries yet.

Ask a Question

Reviews

There are no reviews yet.