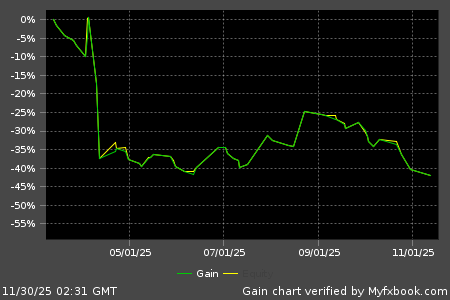

Live Performance Full Result with Myfxbook

| Total Gain | -32% |

| Daily Gain | -0.18% |

| Monthly Gain | -5% |

| Drawdown | 43% |

| Profit Factor | 0.6 |

| Total Pips | 229.8pips |

| Account Currency | USD |

| Deposit | $ 300 |

| Profit | $ -97.05 |

| Balance | $ 202.95 |

| Equity | $ 202.95 |

| Swap | $ 0 |

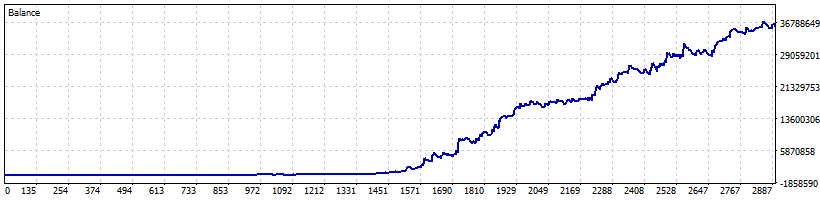

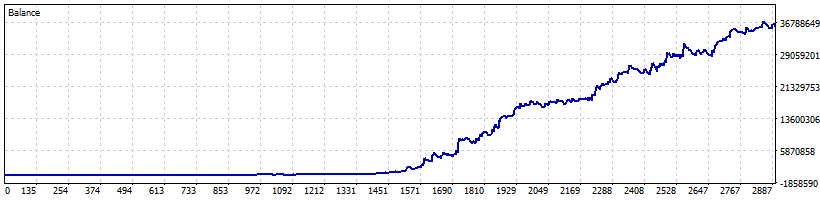

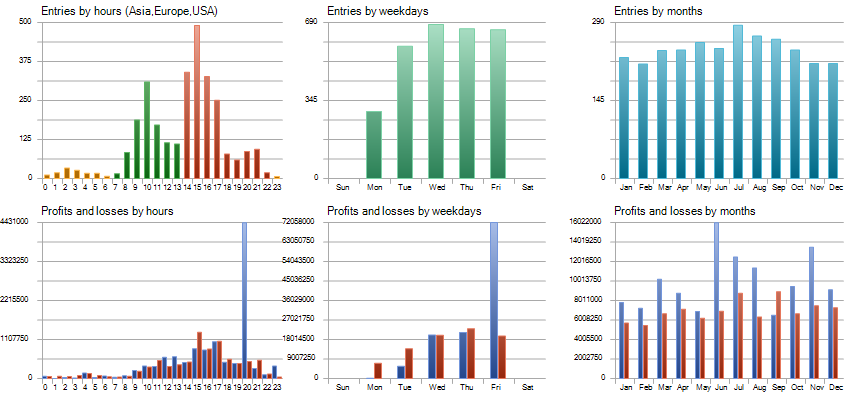

Backtesting

| Total Gain | 7173044.3% |

| Yearly Gain | 80.6% |

| Monthly Gain | 5% |

| Daily Gain | 0.16% |

| Relative Drawdown | 73% |

| Profit Factor | 1.43 |

| Currency | USD |

| Final Balance | 35865721.56 |

| Initial Deposit | 500 |

| Total Net Profit | 35865221.56 |

| Total Trades | 2886 |

| Timeframe | H1 |

![]() MetaTrader 5 (MT5)

MetaTrader 5 (MT5)

- Works even with low leverage (1:25, 1:30, etc.)

- No Martingale, no Grid, no Scalping

- Low-risk strategy with an excellent Risk-Reward Ratio (RR)

- Verified with forward testing on real accounts

- Verified with backtesting over 20+ years

Description

Target Currency Pairs and Timeframes

The target currency pairs are EURUSD, USDJPY, and XAUUSD.

The timeframe used is 1-hour. This EA includes a compounding function, allowing assets to grow significantly over time. It is designed with a focus on risk management and aims for long-term profitability.

Main Features of the EA

This EA emphasizes risk management and incorporates features to achieve stable and efficient profit generation. Below are its main characteristics:

- No Martingale or Grid Trading:

This EA avoids risky martingale or grid trading. Every position is assigned an individual stop loss to mitigate excessive risk. This ensures stable trading and prevents large drawdowns in a single trade. - Compounding Function:

The EA supports compounding, automatically adjusting trade lot sizes in line with account growth. This enables significant profit potential even from a small starting capital and supports long-term asset growth. - Breakout Strategy:

The EA detects market breakouts and enters trades with strict risk management. It employs symmetrical entry logic for both long and short positions, maximizing profit opportunities.

Trade Strategy Overview

This EA is built to detect market breakouts and enter trades based on symmetrical logic for long and short positions. It generates signals using specific indicators.

Logic Overview

- Indicators Used:

DMI (DI+, DI-), ROC (Rate of Change), ATR (Average True Range). - Entry Rules:

The EA analyzes indicator movements over a specified period and enters trades when market volatility increases. - Exit Rules:

Positions are closed using trailing stops, automatic closing after a specified number of bars, or when a profit target is reached.

Capital Management Parameters

- UseMoneyManagement:

Enables or disables the capital management feature. When enabled, lot sizes are automatically adjusted based on account balance, enhancing risk management and optimizing trade size relative to account fluctuations. - mmRiskPercent:

Risk percentage when capital management is enabled. This defines the maximum percentage of account equity to risk per trade. - mmLotsIfNoMM:

Fixed lot size to use when capital management is disabled. - mmMaxLots:

Maximum lot size the EA can use for a trade, ensuring controlled risk in volatile markets.

Exit Settings for Specific Conditions

- ExitOnFriday:

Enables or disables the feature to close all positions on Friday to mitigate risks associated with weekend market gaps. - FridayExitTime:

Specifies the time (in 24-hour format) on Friday to close positions, protecting account equity from unexpected weekend risks.

Conclusion

This EA targets breakout opportunities in EURUSD, USDJPY, and XAUUSD markets while maintaining strict risk management. With compounding capabilities and flexible risk control settings, it caters to a wide range of traders, from beginners to advanced users. It supports asset growth even with a small starting capital and is designed for long-term profitability by balancing risk and return effectively.

Strategy Tester Report |

||||||||||||

MetaQuotes-Demo (Build 4709) |

||||||||||||

Settings |

||||||||||||

| Expert: | Long term proven Lobster EA | |||||||||||

| Symbol: | EURUSD | |||||||||||

| Period: | H1 (2006.01.02 - 2024.11.28) | |||||||||||

| Inputs: | MagicNumber=11111 | |||||||||||

| MagicNumber2=11112 | ||||||||||||

| BBRangePeriod1=50 | ||||||||||||

| DIlPeriod1=20 | ||||||||||||

| ExitAfterBars1=26 | ||||||||||||

| MTATRPeriod1=14 | ||||||||||||

| MoveSL2BECoef1=4.9 | ||||||||||||

| MoveSL2BECoef2=3.2 | ||||||||||||

| PriceEntryMult1=2.9 | ||||||||||||

| PriceEntryMult2=0.5 | ||||||||||||

| ProfitTarget1=3.0 | ||||||||||||

| ROCPeriod1=13 | ||||||||||||

| StopLossCoef1=1.6 | ||||||||||||

| StopLossCoef2=1.5 | ||||||||||||

| TrailingStopCoef1=3.4 | ||||||||||||

| TrailingStopCoef2=3.6 | ||||||||||||

| smm=----------- Money Management - Risk Fixed % Of Balance ----------- | ||||||||||||

| UseMoneyManagement=true | ||||||||||||

| mmRiskPercent=3.0 | ||||||||||||

| mmDecimals=2 | ||||||||||||

| mmLotsIfNoMM=0.1 | ||||||||||||

| mmMaxLots=500.0 | ||||||||||||

| seof=----------- Exit On Friday ----------- | ||||||||||||

| ExitOnFriday=true | ||||||||||||

| FridayExitTime=20:40 | ||||||||||||

| Company: | MetaQuotes Ltd. | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 500.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results |

||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 117179 | Ticks: | 26901443 | Symbols: | 1 | |||||||

| Total Net Profit: | 35 865 221.56 | Balance Drawdown Absolute: | 241.66 | Equity Drawdown Absolute: | 244.30 | |||||||

| Gross Profit: | 119 400 204.74 | Balance Drawdown Maximal: | 3 151 050.00 (9.88%) | Equity Drawdown Maximal: | 4 072 550.00 (12.43%) | |||||||

| Gross Loss: | -83 534 983.18 | Balance Drawdown Relative: | 72.32% (675.12) | Equity Drawdown Relative: | 73.01% (691.76) | |||||||

| Profit Factor: | 1.43 | Expected Payoff: | 12 427.31 | Margin Level: | 193.24% | |||||||

| Recovery Factor: | 8.81 | Sharpe Ratio: | 2.02 | Z-Score: | -8.91 (99.74%) | |||||||

| AHPR: | 1.0048 (0.48%) | LR Correlation: | 0.90 | OnTester result: | 0 | |||||||

| GHPR: | 1.0039 (0.39%) | LR Standard Error: | 5 391 883.79 | |||||||||

| Total Trades: | 2886 | Short Trades (won %): | 1368 (36.77%) | Long Trades (won %): | 1518 (32.02%) | |||||||

| Total Deals: | 5772 | Profit Trades (% of total): | 989 (34.27%) | Loss Trades (% of total): | 1897 (65.73%) | |||||||

| Largest profit trade: | 1 557 000.00 | Largest loss trade: | -335 000.00 | |||||||||

| Average profit trade: | 120 728.22 | Average loss trade: | -44 035.31 | |||||||||

| Maximum consecutive wins ($): | 7 (1 386 150.00) | Maximum consecutive losses ($): | 17 (-1 281 350.00) | |||||||||

| Maximal consecutive profit (count): | 3 206 897.82 (4) | Maximal consecutive loss (count): | -1 877 350.00 (16) | |||||||||

| Average consecutive wins: | 2 | Average consecutive losses: | 4 | |||||||||

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

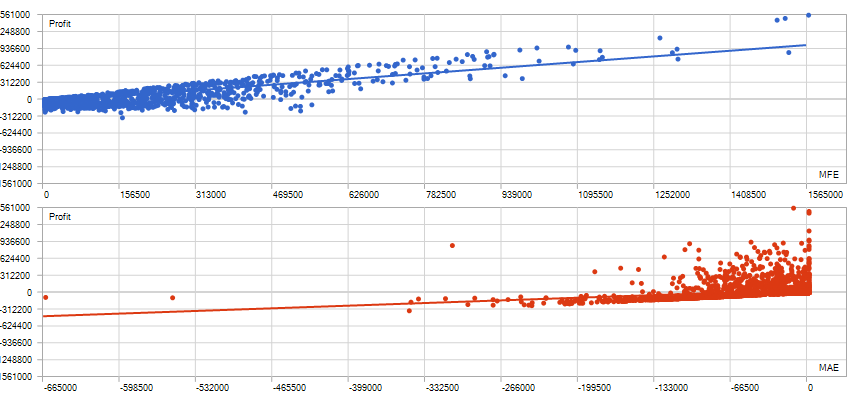

| Correlation (Profits,MFE): | 0.81 | Correlation (Profits,MAE): | 0.28 | Correlation (MFE,MAE): | -0.1519 | |||||||

|

||||||||||||

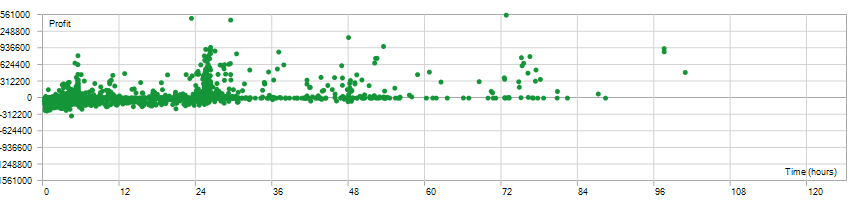

| Minimal position holding time: | 0:00:19 | Maximal position holding time: | 100:33:00 | Average position holding time: | 12:14:42 | |||||||

|

||||||||||||

General Inquiries

There are no inquiries yet.

Ask a Question

Reviews

There are no reviews yet.