First things first: What is walk-forward? How is it different from a backtest?

Walk-Forward (WFA) means you choose EA settings on one period (in-sample, IS), then check whether those same settings still work on the next, unused period (out-of-sample, OOS). You slide the window forward and repeat.

- Backtest: Replays the entire past at once. Optimization can make results look better than reality.

- Walk-forward: Tests generalization to unknown periods step by step — a practical gauge of future robustness.

As a buyer, you can’t see which “school” of WFA a developer follows. That’s why the most important thing you can verify is the publicly available live-account forward performance — in effect, a real-money walk-forward.

Walk-forward analysis helps to eliminate over-optimization of EAs.

Related article: Avoid Overfitted EAs: A Pre-Purchase Checklist

Types of walk-forward analysis (buyer-friendly overview)

- Simple IS/OOS split: Split the past once into “training” and “unused” periods. Easy to understand, but more sensitive to luck.

- Rolling WFA (sliding): Tune on IS → test immediately after on OOS, and keep moving forward. Usually offers stronger repeatability.

- Variants: Anchored (fixed start), Expanding (IS grows over time).

- Cross-pair / cross-timeframe checks: Apply the same logic and parameters to other pairs/timeframes to see if it doesn’t collapse (a hint of generality).

- Live forward test (real-money WF): Continuously published real-account results are the most trustable WFA a buyer can actually see. Prioritize this over demos and backtests.

What buyers should prioritize: live forward results

You can’t audit the developer’s internal WFA step-by-step. So start with the live account track record.

What to check:

- Account type: On Myfxbook/FXBlue, confirm it’s a Real account (demos are only reference). On Myfxbook, also look for Track Record Verified / Trading Privileges Verified.

MQL5 Signals are also useful; they list real accounts only. - Time & trade count: Look for several months and regime changes (different market environments). Longer publication generally means stronger credibility.

- Behavioral consistency vs backtest: On a monthly basis, do win rate, RR (avg win/avg loss), PF, and Max DD sit in a similar range? As a rough cue, PF within −20% and Max DD within +30% can be considered broadly consistent (not a guarantee).

- Lot behavior: Watch for lot increases during drawdowns (hidden martingale). Don’t stare only at the equity curve — inspect the trade log, especially lot size changes and close times. Sudden lot doubling or many positions closing at the exact same time can indicate grid/martingale.

- Broker & costs: Is the broker/account type disclosed? Are commissions, average spread, and slippage realistic?

Vendor behaviors that suggest “good WFA spirit”

- They run live with the same parameters, and when parameters are updated, they disclose the timing and reason.

- They show secondary pairs (e.g., developed on EURUSD → also tested on USDJPY/XAUUSD with the same settings) and demonstrate it doesn’t fall apart.

- They publish uncomfortable stats too: worst month / stagnation period / max losing streak / largest loss.

Red flags (what to avoid)

- No forward test published at all. Or only a demo, or the live record quickly goes private.

- High win rate × low RR, and largest loss is multiple times the average win.

- Curve “managed” with deposits/withdrawals, or lot increases during DD (hidden martingale).

- User backtesting restricted, broker/cost details are vague.

- Publication period concentrated in favorable regimes only (a pseudo-WFA).

Pre-purchase checklist you can use today

- Mandatory: A real-account live track record is continuously published (Myfxbook verification and/or MQL5 Signal).

- Reasonable balance between trade count/period and PF (e.g., PF 1.3–1.8 with ample trades).

- Not just high win rate × low RR (aim for RR ≥ 1.2–1.5).

- Broker/costs (commissions, spread, slippage) are realistic.

- Applying the same settings to other pairs doesn’t cause a collapse (reference checks).

- Parameter updates (if any) and their reasons are disclosed.

Our policy for EAs listed on this site

- All listed EAs are publicly forward-tested on real accounts without exception.

- Forward tests use major, reputable brokers to ensure transparency and reliability.

- We do not employ martingale, grid trading, excessive scalping, or low-RR tactics.

- We combine cross-pair checks to pursue generality.

- We do not re-optimize internal parameters mid-forward; tests continue with consistent logic and parameters.

Cross-pair examples

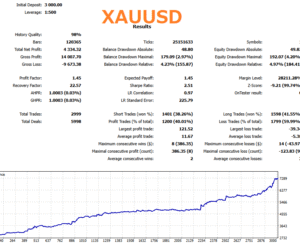

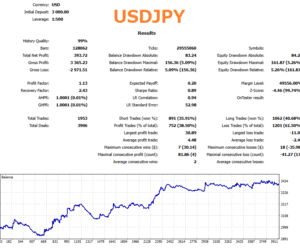

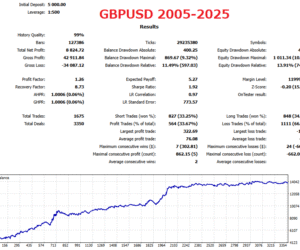

Gold Crab Robot was developed for XAUUSD, but we backtested it on other currency pairs with the exact same parameters. The results below show it holds up reasonably well outside the original symbol.

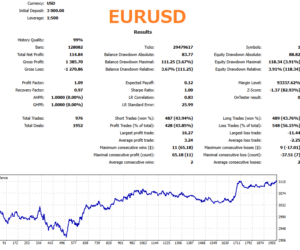

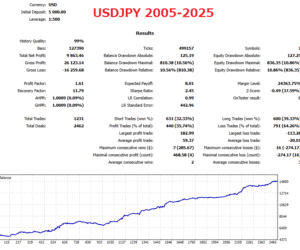

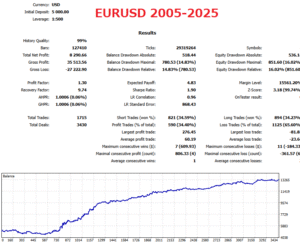

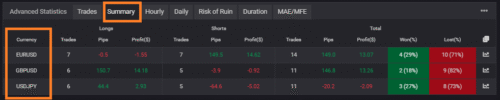

Likewise, Colorful Long-Tailed Tit EA was tested on EURUSD, USDJPY, and GBPUSD with the exact same parameters—no per-pair optimization, one logic for all.

With 20+ years of backtest coverage across multiple pairs, the logic shows signs of generality.

We also run real-account forward tests on these three pairs.

Summary

- Walk-forward = testing whether an EA holds up on unknown periods. You can’t see the developer’s exact WFA method.

- Therefore, prioritize real-account forward performance, and value repeatability and robustness over “high numbers.”

- With this lens, you can greatly reduce the odds of buying an overfitted EA.

FAQ

What is the main difference between walk-forward analysis and a backtest?

A backtest replays the entire past at once, which can lead to over-optimized results. Walk-forward analysis tests generalization by sliding step by step into new, unseen periods, giving a better gauge of robustness.

Why should buyers prioritize live forward results?

Because internal walk-forward steps of developers are not visible to buyers, the most reliable evidence of robustness is a continuously published real-account forward test on Myfxbook, FXBlue, or MQL5 Signals.

What vendor behaviors indicate good “WFA spirit”?

Trustworthy vendors disclose parameter updates, show secondary pairs with the same settings, and publish difficult stats like worst months, stagnation periods, and maximum drawdowns.

What are red flags when evaluating EAs?

Warning signs include no real forward test, only demo results, hidden martingale via lot increases during drawdowns, vague broker/cost details, or results concentrated in favorable regimes only.

What should be included in a pre-purchase checklist?

Check for a real-account track record, reasonable PF and trade volume, realistic broker/cost details, disclosed parameter updates, and that applying the same settings to other pairs does not cause a collapse.