Summary

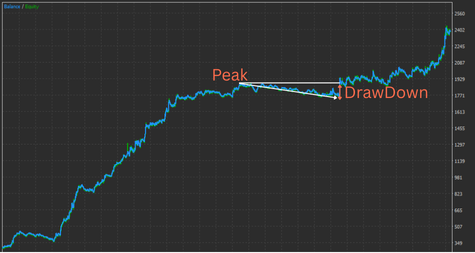

Drawdown (DD) is the decline of the equity curve from its most recent peak as trades incur losses.

The tolerance line is the “maximum decline you can withstand mentally and financially,” determined by formulas and real performance. The safety zone is the area within that line—the conservative operating range.

Definition of Drawdown

Maximum Drawdown (Max DD): the largest drop from any peak to a subsequent bottom within a given period of the equity curve.

Max DD can be expressed either as a percentage or an absolute value.

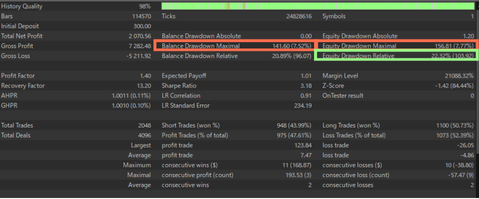

There are two types of drawdown: “balance drawdown” and “equity (floating P/L) drawdown.”

The former is convenient for comparing historical results, but to understand the real risk to account survival you need to check the latter.

Below is an MT5 backtest statistics image showing the key drawdown items you should review.

Equity drawdown is particularly important.

The percentage labeled “Equity Drawdown Relative” is the most important metric when backtesting variable lot sizes tied to account balance.

The Three Factors: Depth, Length, Frequency

Depth: the magnitude of the drop (%)

Length: the time to recover (days / trades)

Frequency: how often it occurs

Key point: even a shallow DD of just a few percent can be psychologically taxing if it lasts a long time. Look at both the numbers and the duration.

Max DD and Risk Tolerance (How to Set a Tolerance Line)

Tolerance line = the maximum decline at which you can keep operating. In practice, quantify it with the following steps.

Step 1: Estimate Expected DD from Tests

When running a trading system, first examine test results. There are two types of tests: backtests and forward tests.

Backtest your own system (EA) and check the size of the DD. A long period—e.g., 20 years from 2005—is preferable.

Run the backtest with the minimum lot so later calculations scale easily when you increase balance.

Example: if a fixed 0.01 lot backtest shows DD = 200 USD, then 0.1 lot implies 2,000 USD and 1 lot implies 20,000 USD of DD.

Thus, with only 1,000 USD balance, operating at 0.1 lots likely exhausts the account.

Next, check the developer’s forward test (e.g., third-party verification like Myfxbook). The longer the period, the more reliable the results; short periods can be noisy.

Step 2: Adjust Conservatively with a Live Factor

Live performance often degrades versus backtests because systems tend to be optimized to past data, and live frictions such as slippage and rejections exist.

Therefore, expand expected DD with a buffer of about ×1.5–×2.0.

Example: backtest DD = 200 USD → assume expected DD = 300–400 USD.

(Assumption: the EA is trustworthy. Fraudulent or overfitted EAs may show abnormally small DD in backtests, making this assumption meaningless.)

Step 4: Decide Tolerable DD and Initial Deposit

Decide how much DD you can tolerate from your balance (e.g., up to 50%).

Example: if you want to cap DD at 50% and expected DD is 400 USD, you need an 800 USD deposit.

This is still based on assumptions. No system is absolute; keep the initial deposit at an amount you can afford to lose entirely without affecting your life.

Operating with an Automatic Lot Size

The above described manual lot sizing. Many EAs also offer an option to size lots automatically based on balance.

Auto-lot sizing can be powerful for growing balance, but DD can also scale with the lot-sizing coefficient.

Thoroughly backtest and observe how DD behaves relative to balance and the lot-adjustment coefficient.

Example: if you want to keep DD within 50% of balance, iterate to find a coefficient that satisfies that condition.

Practical Measures to Reduce DD

You may not fully know a system’s internal logic unless you are the developer, but if parameters are exposed you can often use them to suppress DD. Typical measures include:

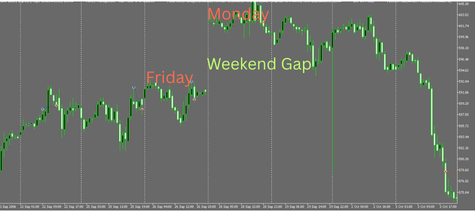

Weekend Close to Avoid Tail Risk

Most FX pairs are closed on weekends. Markets can open on Monday with large gaps, so holding positions over the weekend carries unexpected loss risk.

Configure the system to close all positions at a set time on Friday to avoid large gap losses.

Set a Cap on Concurrent Positions

Holding many positions in the same direction can magnify losses when price moves against you.

Example: holding five long positions into a decline can escalate losses.

Limiting same-direction position counts can help; however, an EA that adds unlimited positions in one direction is inherently very high risk and not recommended.

Avoid Events / Use a News Filter

Major releases such as U.S. Nonfarm Payrolls can greatly increase volatility in USD pairs.

Mean-reversion EAs with wide stop losses and long holds can suffer a single, large DD during such events.

For these types, closing before events or blocking new entries around releases can be effective.

Whether event avoidance or a news filter helps depends on the trading logic.

DD-Reduction Measures for EAs Listed on This Site

Weekend Close

Our EAs generally implement weekend close and enable it by default.

Concurrent Position Limits

Most of our EAs allow only one position per direction per logic. Some EAs use multiple logics, so they may hold multiple positions in the same direction, but they are designed not to hold a large number simultaneously, keeping risk low.

News Filter

Because many of our EAs are breakout or momentum-following types that can benefit during releases, we generally do not implement a news filter.

Eliminating Risky Designs

EAs using Martingale or Grid methods can produce very large DD.

Grid strategies keep adding positions until they win, yielding high short-term win rates and a seemingly smooth upward curve, but in a strong trend floating losses balloon and equity can approach zero.

Martingale doubles lot size after losses, so a losing streak can cause catastrophic DD.

Even if the curve looks clean in the short term, the high long-term failure probability means these should generally be avoided.

How to Think About Drawdown

It is risky to hate DD to the extreme and believe “the best system has no drawdowns at all.”

FX price movements are complex and essentially irregular; no system wins in every market regime.

If backtests or forward tests show extremely small DD, beware of overfitting, risky long holds, or hidden grid/martingale logic.

Instead, cap losses with stop losses when the market moves against your hypothesis, accept DD within reason, and aim to grow equity over the long term with a strategy that has true edge.