Table of Contents

- What is Quantum Queen EA?

- Key Features & Strategy Logic

- Deep Dive into Live Performance

- Why Back-tests Are Limited to 2018+

- Pros vs Cons

- Safety Guidelines

- Verdict: Buy or Pass?

- Frequently Asked Questions (FAQ)

1. What is Quantum Queen EA?

This EA looks tempting—especially to beginners—but relies on a grid + martingale approach that can blow an account in one streak. Evidence of cherry-picked back-tests suggests low reliability. Handle with care.

- Marketplace: MQL5 Market

- Symbol: XAUUSD (Gold)

- Suggested Time-Frame: Not stated (most users run M1–M5)

- Price: ~USD 1,000 (occasionally discounted)

2. Key Features & Strategy Logic

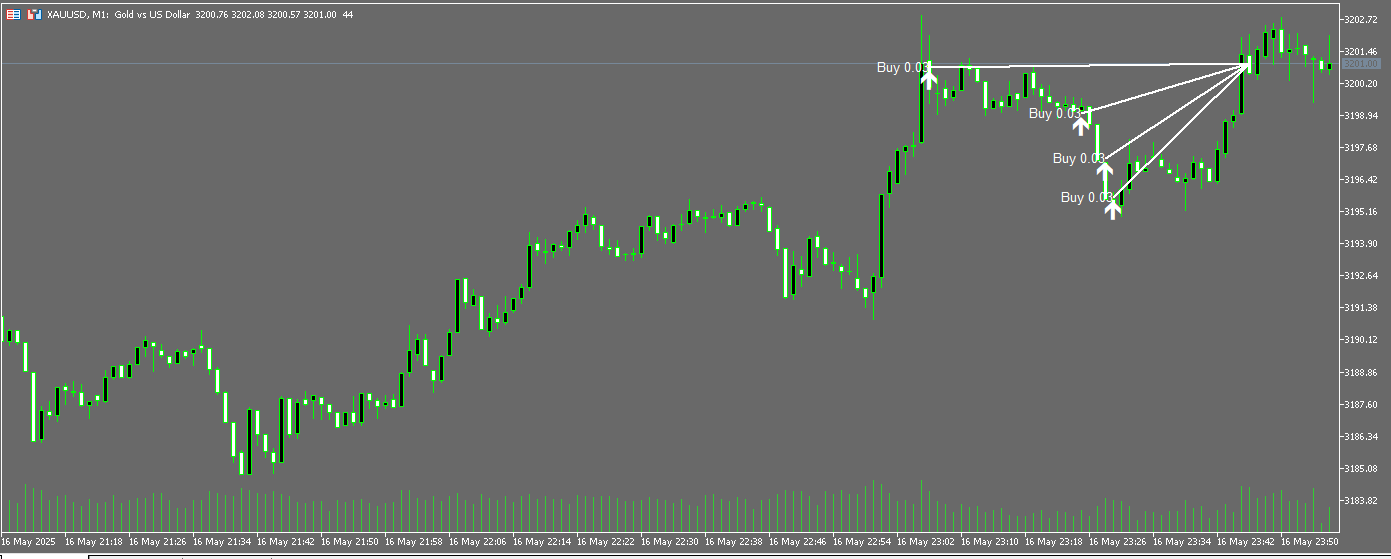

- Core Method: Grid + Martingale

- Grid Step: 60–70 pips (fixed)

- Lot Scaling: Doubles gradually from the 4th order onward

- Trade Frequency: Low (a few – dozen trades per day)

- Stop-Loss: Effectively “account wipe-out = SL”

✦ Quick Notes

- Simple Grid – profitable in ranging markets.

- Martingale Risk – lots balloon while holding drawdown, equity collapses fast.

- Few Entries – fewer trades, but often late to strong trends.

3. Deep Dive into Live Performance

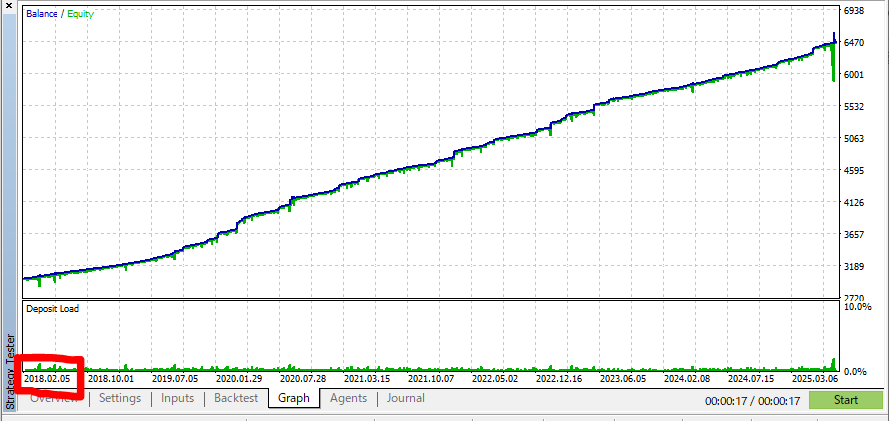

3-1. Why the Live Curve Looks “Great”

Grid EAs average down, so equity climbs until a one-way trend hits—then it’s lot escalation → margin level crash → margin call.

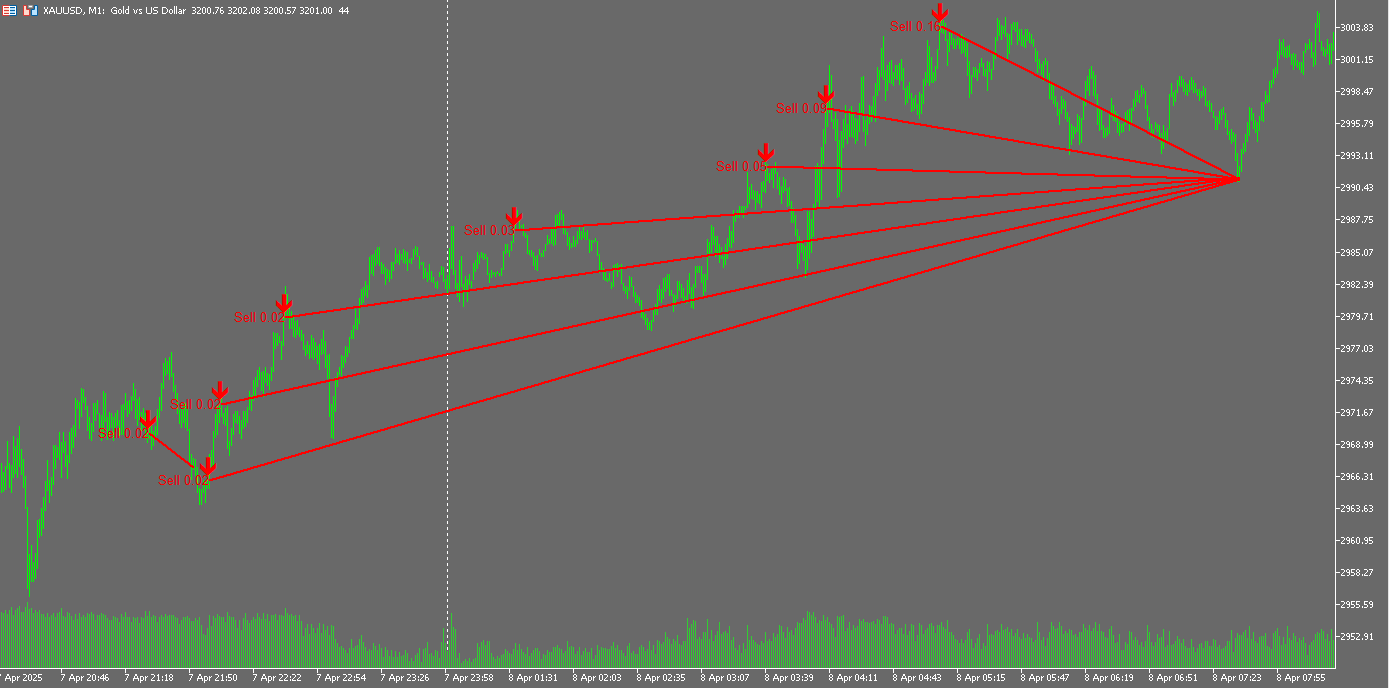

3-2. Risks Visible on the Chart

- Red lines converge = all positions closed together

- Long drawdowns throttle capital efficiency

- Gold’s volatility delivers bigger-than-expected adverse moves

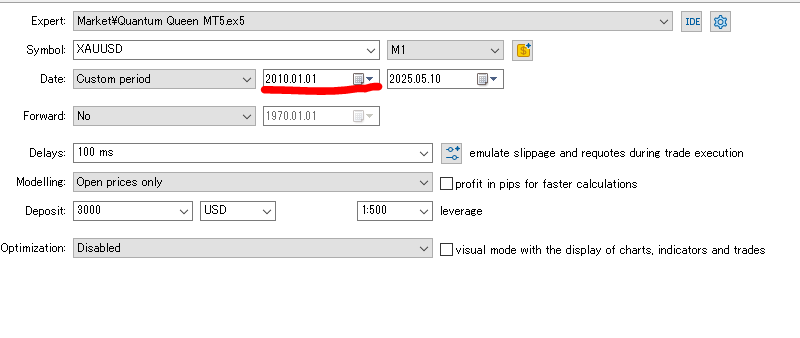

4. Why Back-tests Are Limited to 2018+

- Ducks big swings pre-2018 (e.g., 1,000-pip spikes in 2013 & 2016)

- Data-snooping bias — shows only “good” periods

- Transparency issues — full-range tests back to 1999 are missing

👉 Tip: Download the demo and back-test from 2000 onward yourself.

5. Pros vs Cons

Pros

- Plug-and-play setup

- Fully automated—no manual work

- Can post strong returns in select periods

Cons (Critical)

- Very high chance of account wipe-out

- Lot ballooning triggers steep drawdowns

- Extremely vulnerable to high-volatility moves

- Equity curve beauty is an unrealized-loss disguise

- Auto-lot gets riskier as balance grows

6. Safety Guidelines

*Only if you insist on testing—still not recommended.

- Account Type: Micro / Cent

- Capital: ≥ USD 1,000

- Max Lot: 0.01–0.05 fixed (auto-lot OFF)

- Max Orders: Cap at 3–4 grids

- Trading Hours: Asia session; pause before major US news

- Regular Cash-out: Withdraw 10–20 % of profit to secure capital

7. Verdict: Buy or Pass?

If you’re not ready to lose the entire account, skip this EA.

- Grid + Martingale is destined to crash eventually

- Developer hides old data—trust is shaky

- Gold’s volatility pairs terribly with martingale

Pre-purchase Checklist

- Confident you can “hit-and-run” for short-term gains?

- Capital spread across multiple accounts?

- Ready to treat the cost as “tuition”?

If any answer is “No”, look for lower-risk EAs or invest in trading education.

8. Frequently Asked Questions (FAQ)

- Q1. Is fixed-lot mode safe?

- A. Slightly safer, but long trends can still wipe the account.

- Q2. Do I need a VPS?

- A. Yes for 24/7 operation, but profits may not outpace the cost.

- Q3. Can I trust the official back-tests?

- A. No—tests stop at 2018. Results before that are hidden and likely disastrous.

I went over this site and I conceive you have a lot of good info , saved to favorites (:.

Thank you very much for your comment.

I’m very sorry, but this site is no longer appearing in Google search results, so I will be closing it down soon.

I plan to launch a new website.

I’ll contact you again.